LNG “major boon” for EPC contractors and project carriers

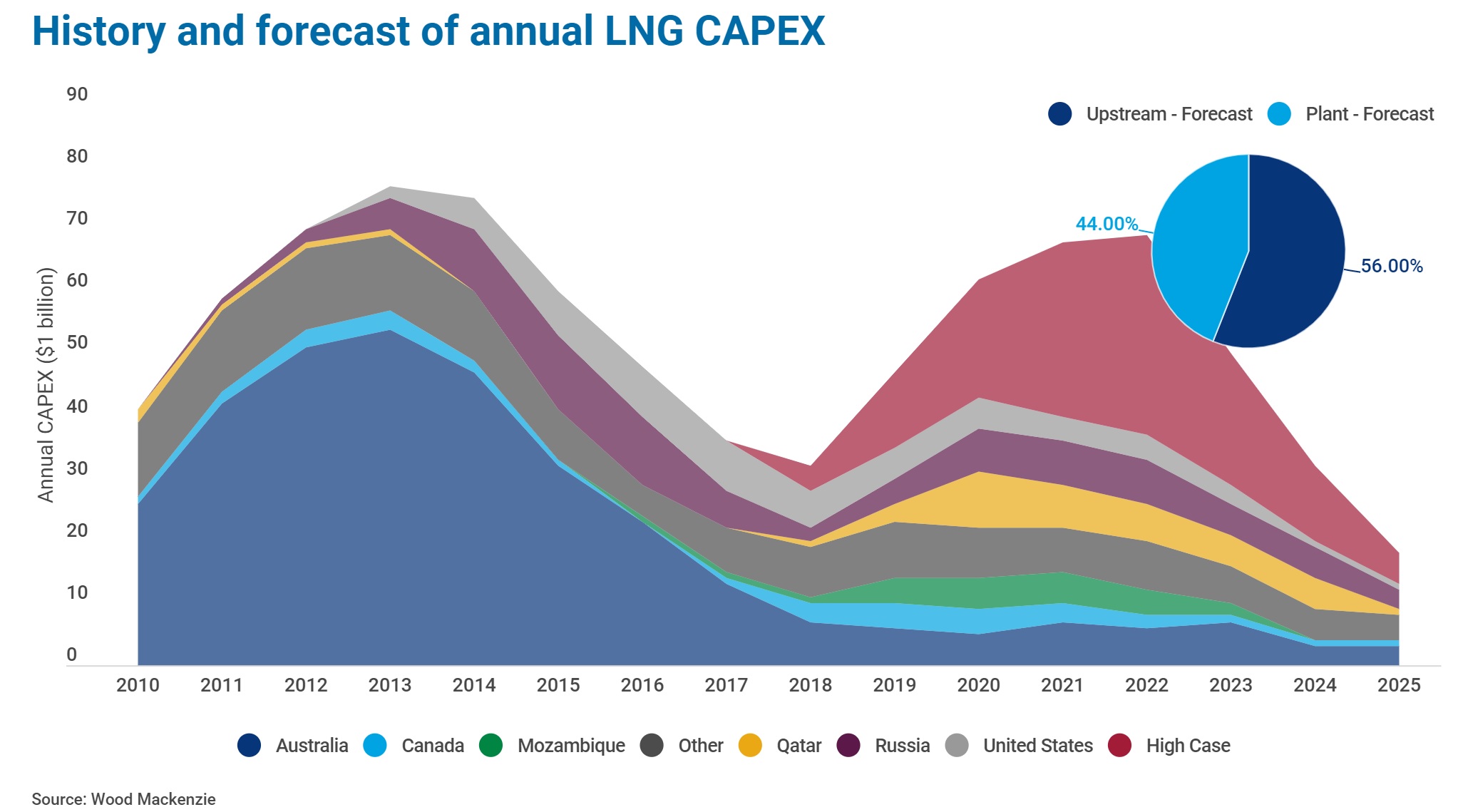

EPC contractors and project carriers can expect a rise in demand as final investment decisions are taken on the construction of a large number of new LNG plants. Over the next two years, almost 90 mmtpa of liquefied natural gas is expected to start construction. Capital expenditure will total more than 200 billion dollars between now and 2025.

“This is a major boon for engineering, procurement and construction (EPC) contractors and other providers along the supply chain,” says consultancy firm WoodMackenzie. The analysts do note that the LNG industry is notorious for cost overruns and project delays. Only 10% of all LNG projects have been constructed under budget, while 60% have experienced delays.

“While there is a risk that current low LNG prices may cause some proposed projects to be cancelled, we think the risk to new LNG supply development is actually to the upside. In our high case we anticipate that an additional 70 mmtpa could be sanctioned in the next three years. Should even some of this materialise, construction would be stretched beyond the heights of the boom from 2010-2014,” WoodMackenzie writes in a market analysis.

Cost overruns

After years of plummeting workloads, EPC contractors would of course welcome increase in spending. While LNG operators have enjoyed a return to profits in recent years, many LNG EPC contractors remain firmly in the red. Caused by tough contract conditions, which in turn were a result of the tough market, EPC contractors have taken financial hits from project cost overruns as seen at Ichthys, Cameron and Freeport, Wood Mackenzie says. “But with an increase in workload, there is the potential for a recovery in project revenues for EPC contractors.”

Other parts of the value chain are also likely to see an increase in workload. A lean time for upstream subcontractors has resulted in a 25% drop of workload capacity across the sector. An uptick in activity is expected to bring higher rig rates but also to increase subsea costs.

Cost overruns in the previous boom averaged 33%, with Australian projects overrunning by 40%. While Wood Mackenzie does not expect similar increases this time, the potential for operators and contractors to drop the ball on project delivery remains. This risk will only be heightened if more projects go ahead than our base case forecast. “Only time will tell whether LNG will start to shrug off its difficult delivery reputation,” the analysts conclude.