Port of Antwerp-Bruges breakbulk throughput shows signs of recovery

First-quarter breakbulk throughput at the Port of Antwerp-Bruges is showing signs of recovery despite landing 7.8 per cent below the figures in the first quarter of last year. The recovery is reflected in a 6.9 per cent jump from the last quarter of 2023.

Throughput of iron and steel remained unchanged, with incoming flows growing 1.4 per cent and outgoing flows falling 3.8 per cent. Most other goods recorded a decline compared to the first quarter of 2023.

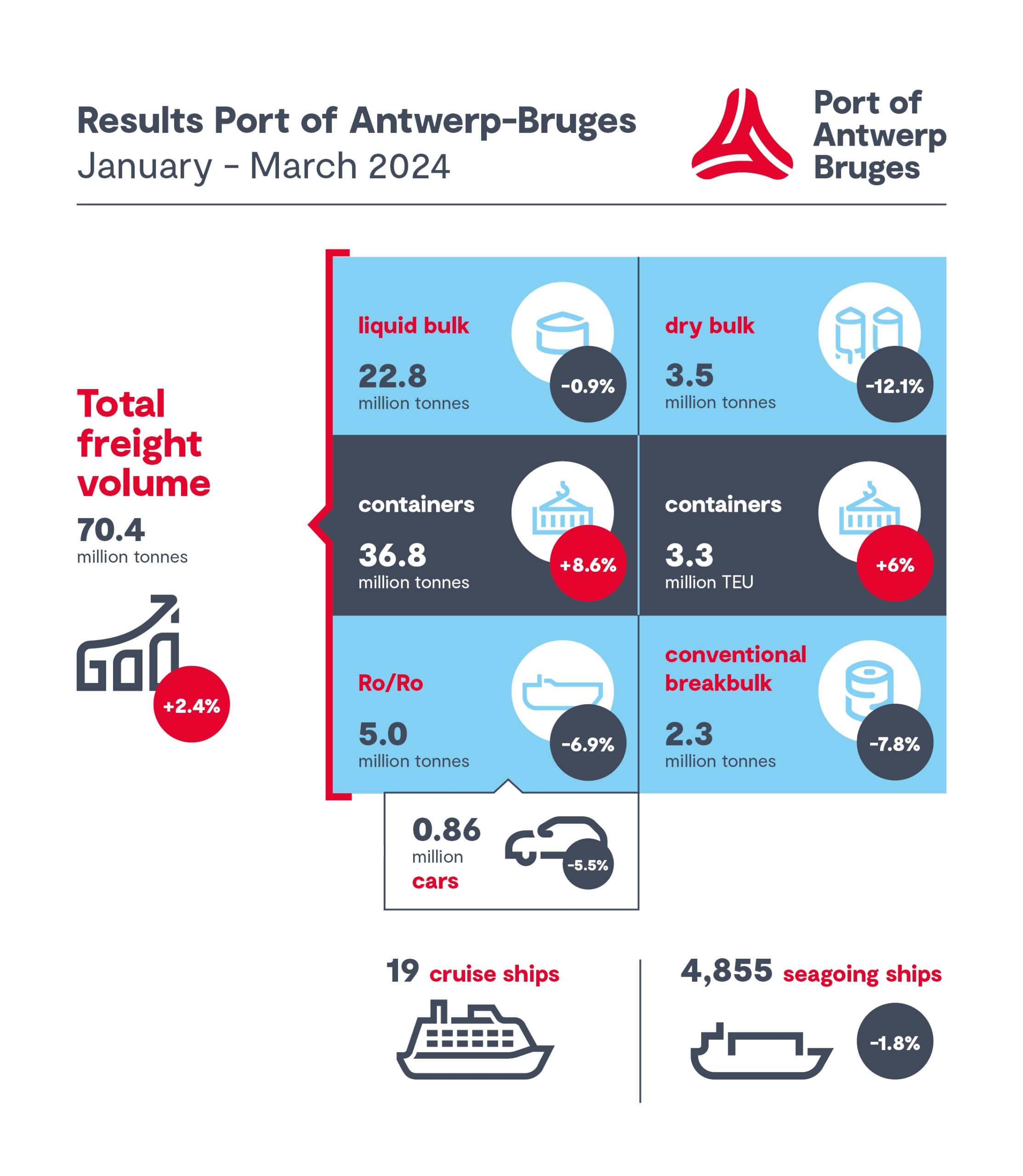

Roll-on/roll-off traffic decreased by 6.9 per cent in the first quarter of 2024. The ongoing congestion at RoRo terminals resulted in a 9 per cent decrease in throughput of all transport equipment. This is mainly due to lower throughput of used cars (-52.5 per cent), as well as high & heavy (-25 per cent), trucks (-23.9 per cent) and new cars (-5.5 per cent). Throughput of unaccompanied cargo (excluding containers) carried on RoRo vessels grew by 1.7 per cent.

The decline in throughput to and from the United Kingdom (-4.4 per cent) was offset by an increase in throughput to and from Spain and Portugal (+31.5 per cent), Ireland (+6.4 per cent) and Scandinavia (+13.5 per cent).

Total cargo throughput on the up

The total cargo throughput of Port of Antwerp-Bruges amounted to 70.4 million tonnes in the first quarter of this year, a rise of 2.4 per cent compared to the same period last year. In an ongoing complex geopolitical and macroeconomic context, this performance, driven by a return to growth in container throughput, underscores the port’s resilience.

After economic uncertainty and inflation led to a global slowdown in demand for container shipping in 2023, container throughput picked up again from February, with March even witnessing the best monthly throughput since March 2021. This resulted in a rise in total container throughput of 8.6 per cent in tonnes and 6 per cent in TEUs (3,287,000 TEUs), compared to the first quarter of 2023. Port of Antwerp-Bruges’ market share in container handling in the Hamburg – Le Havre Range grew by 0.3 percentage points in 2023, to 29.9 per cent.

Jacques Vandermeiren, CEO Port of Antwerp-Bruges, said, “The fact that, as a world port, we are caught up in continuing challenges was once again highlighted in the last quarter. The Red Sea unrest obliged container shipping companies, for security reasons, to divert their routes via the Cape of Good Hope on East-West routes, resulting in disruptions to logistics chains and irregular arrivals of container ships. This meant that all parties involved had to adapt, but diverted routes soon became the ‘new normal’. The fact that we can once again achieve growth despite everything proves our resilience in unpredictable times.”

You just read one of our premium articles free of charge

Register now to keep reading premium articles.