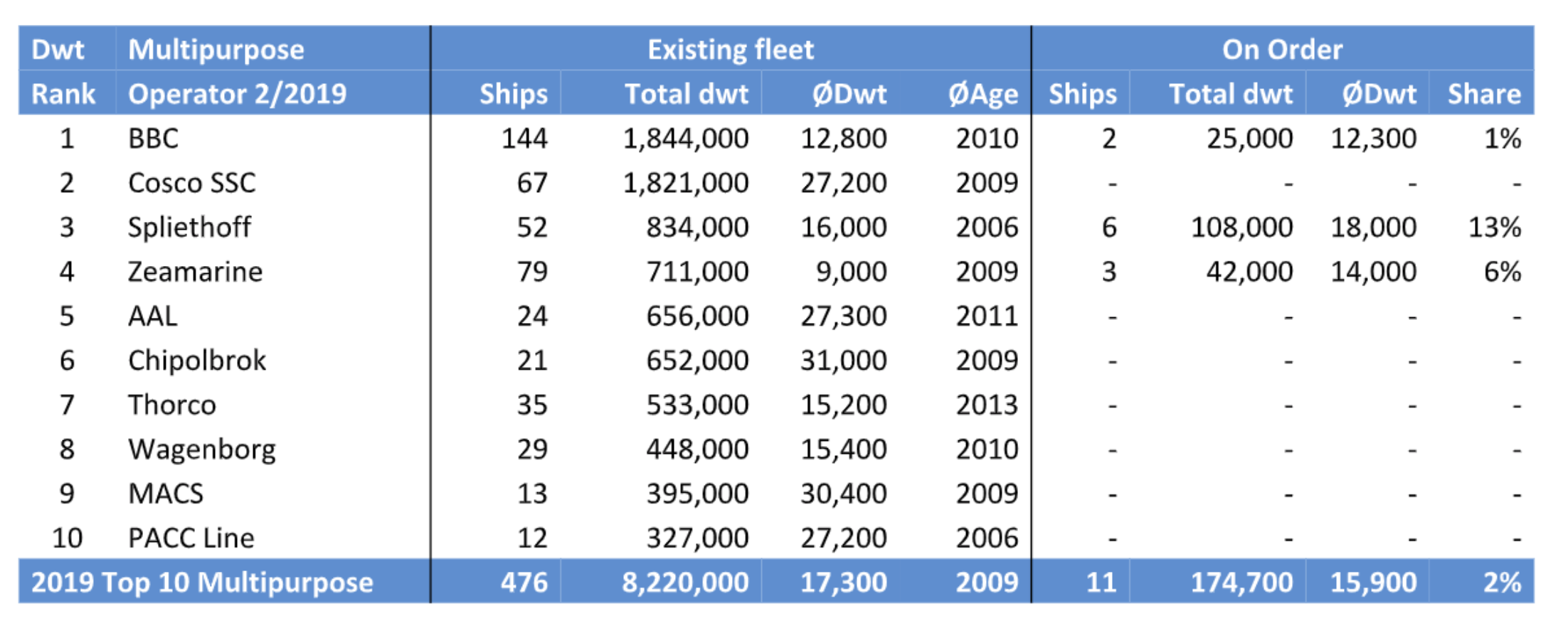

BBC Chartering reclaims crown from Cosco

BBC Chartering regained the number one position in the top-10 ranking of multipurpose vessel operators, a place which it lost to Cosco Shipping Specialised Carriers early last year.

With a fleet of 144 vessels, BBC Chartering owns 30% of the entire top-10 fleet, writes consultancy firm Dynamar in its latest breakbulk report. Notable is that the total deadweight of those 144 vessels amount 1,844,000 tons, while Cosco’s combined deadweight sums up to 1,821,000 tons with only 67 vessels, clearly showing a large number of bigger vessels in the Chinese fleet. Cosco’s ships have an average deadweight of 27,200 tons. That’s more than double than BBC Chartering’s vessels have, although the German shipping company did see its average ship size grow from 11,500 to 12,800 tons.

Cosco surpassed BBC Chartering early last year when the company took delivery of the last of an extensive 23-unit newbuilding programme. Amongst others, it comprised 38,000-dwt ships, ranging among the largest multipurpose ships in the world. The state-owned shipping has been expanding aggressively in many markets. In the container shipping sector, Cosco quickly climbed the ranks from 7th to 3rd through a merger with China Shipping, a takeover of OOCL and a large newbuilding program.

CoscoSSC also deploys semi-submersible vessels (7), car carriers (6), log carriers (11) and asphalt carriers (15) which are not included in Dynamar’s multipurpose ranking.

Article continues below image.

Spliethoff

When it comes to fleet size, BBC Chartering and Cosco are clearly in a league of their own. Second runner-up Spliethoff has a fleet of 52 vessels totaling a deadweight of 832,000 tons, a million tons less than BBC Chartering. It is important to note, however, that ships operated by Spliethoff’s subsidiaries BigLift, Bore, Sevenstar, Transfennica and Wijnne Barends, are not included in their parent’s fleet. Spliethoff does have six 18,000 dwt vessels on order.

The Dutch shipowner recently made the headlines by buying five ships from defunct Hansa Heavy Lift. While the average hoisting capacity of the Dutch operator’s vessels ranges between 160 and 300 tons, one of these vessels has a heavy-lift of 800 tons. “It is suggested that the Prinsengracht, as she is called, may become the first of a new P-series with an indeed higher than so far usual lift,” Dynamar writes in its report. Reportedly, the company is also buying the six remaining vessels from Hansa Heavy Lift, which would add more heavy lift capable ships to its fleet.

Zeamarine

The newly formed 75/25 joint venture Zeamarine of Zeaborn and Intermarine has risen to a fourth position in the ranking. But with a fleet of 79 vessels, the joint venture is behind on schedule, Dynamar notes. “The JV had the stated purpose to operate some 100 multipurpose ships by early 2019, that goal has, so far, not yet been achieved. Actually in January last, Intermarine and Zeaborn as was operated six ships more than today’s JV. However, the company is clearly gambling on the growing availability of distress tonnage,” the analysts write.

In an interview with Maritime CEO managing partner Ove Meyer said about 30% of the world’s multi-purpose fleet is not able to pay their debts. According to Meyer these assets are being held by banks and are ready to be traded off.

Thorco Projects

Also Notable is the position of Thorco Projects, which fell from the third to seventh place. Thorco Projects continues reducing its fleet with this time the number of ships falling by 13 units (221,000 dwt) to 35 vessels with a combined deadweight of 533,000 tons. “Strikingly, it has no longer ships with a Clipper or UHL (United Heavy Lift) names style in its current fleet. Last year, these still accounted for eight units,” Dynamar states.

As of early March 2019, the ten largest operators deployed a fleet of 476 ships with a total deadweight of 8,220,000 million tons and an aggregate lifting capability of 155,000 tons. There are currently 11 vessels with a combined capacity of 175,000 tons on order. That amounts to just 2% of the current fleet.