Project carriers face increased competition from ro/ro companies

The project cargo industry faces increased competition from car carriers as the sector struggles with slow growth rates and political uncertainty in the car business. Companies like Wallenius Wilhelmsen are working hard to expand their presence in the breakbulk and project markets.

Car carrier shipping is struggling with slow growth, rising costs and an uncertain market outlook due to rising geopolitical risk. Analysts of Drewry expect that this will trigger more distressed vessel sales.

Seaborne trade in finished vehicles, including high & heavy and used autos, continued to grow from 2016’s low, but the rate of the recovery remains slow. In 2018, the market grew with 1% to 22.8 million units. Although this trend has continued into 2019, the industry now faces serious challenges ahead.

Car sales globally are declining and the trade war between the US and China is adding fuel to the fire. Professor Ferdinand Dudenhöffer, chairman of Germany’s Center for Automotive Research (CAR), earlier this year warned that 2019 will leave a deeper scar in the auto industry than 2009.

“According to our more conservative forecast, vehicle sales worldwide will decline by more than 4 million new cars in 2019. Globally this is twice as big a decline as in the midst of the global financial crisis,” he told Forbes.

In a recent Tweet, Dudenhöffer says the car industry is now in a state of crisis in and that Trump’s trade war is costing the industry around USD 700 billion worldwide.

#Autokrise kostet weltweit rund 700 Mrd Euro#USA schädigen mit #Trumps Zollpolitik deutsche #Autoindustrie. Wertschöpfungsvernichtung in Autoindustrie weltweit 700 Mrd. Euro #Zulieferer #automotiveindustry #Wirtschaft #economy #VW #Daimler #BMWhttps://t.co/nBgizIpnT6

— Ferdinand Dudenhöffer (@DudenhofferAUTO) 2 oktober 2019

For car carriers, this means that matching supply and demand is becoming increasingly challenging, Drewry states.

Project cargo

As a result, car carriers will increasingly chase breakbulk and project cargo. Wallenius Wilhelmsen recently strengthened its breakbulk team with senior manager Vedran Muratbegovic, who will work on global breakbulk business development.

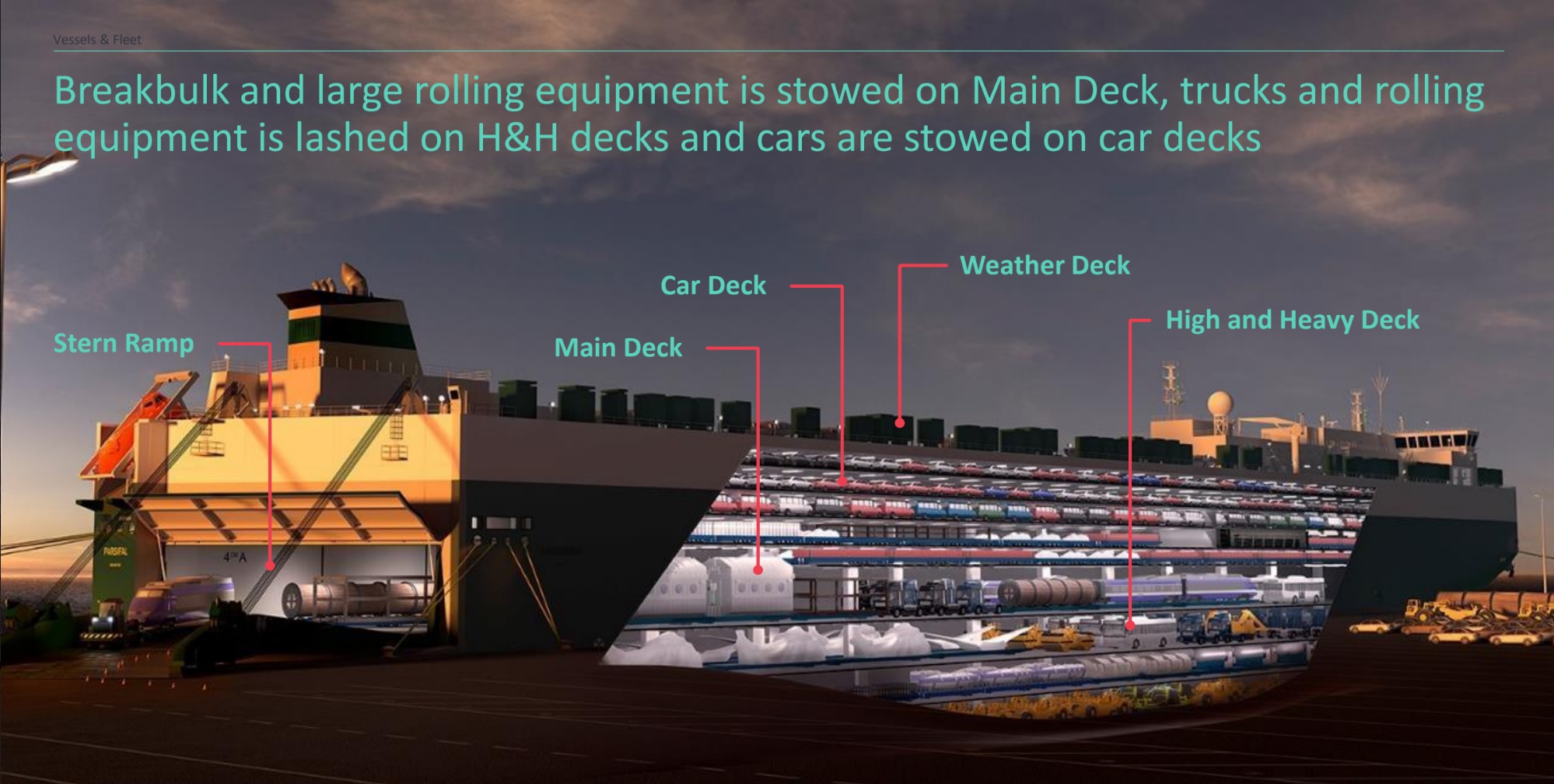

Speaking at the Project Cargo Summit, Muratbegovic said: “Ro/ro shipping may not be widely known as an option for breakbulk yet, but we are working hard to convince customers that it’s actually the safer and smarter way. In comparison with lo/lo vessels(lift-on/lift-off, or multipurpose vessels, ed.), we have more frequent and reliable service offerings and a much lower risk of damage. We only need to lift cargo once to place it on a trailer and we never have to lift it more than 1 metre above the ground.”

In recent years, Wallenius Wilhemsen has invested in ro/ro vessels that can carry large project cargoes on its main deck. One market the company is targeting is the wind industry, where it uses its frequent and reliable sailings as an argument to create a stable supply chain. There are also disadvantages to WW’s fixed service network. Because the company has to maintain its schedule for the auto industry, WW’s vessels are a lot less flexible than multipurpose vessels are. As Muratbegovic puts it: “Cars are our bread and butter, but breakbulk is our masterpiece.”