Decline in charter rates starts to slow

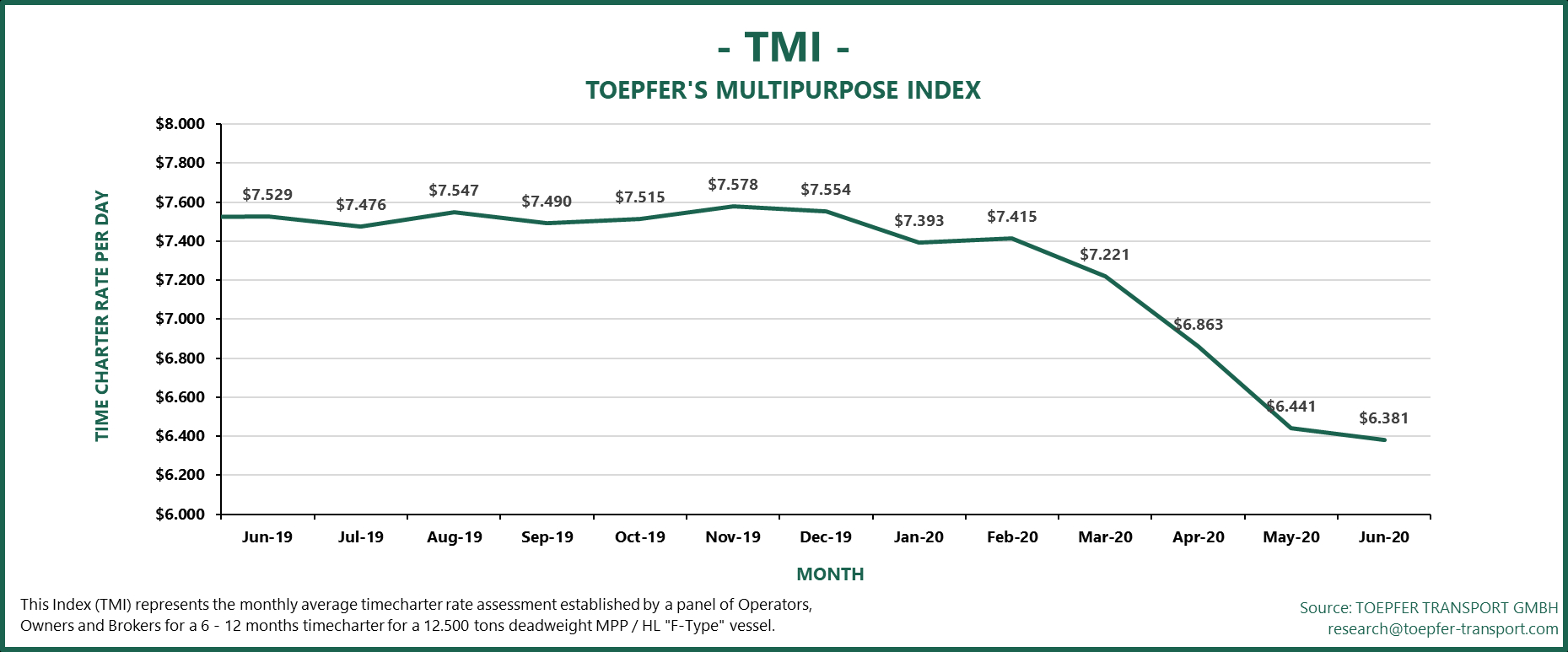

Average charter rates kept falling in the past month but the decline has significantly slowed in pace. In June, the average day rate for a 12,500 dwt multipurpose vessel fell by 60 dollars compared to May and now stands 6,381 dollars.

While the decline does not seem to have bottomed out yet, it did considerably slow its pace compared to May and April when the average charter rates fell by approximately 400 dollars month-on-month, Toepfer’s Multipurpose Shipping Index shows.

Due to the long-term nature of the project cargo industry, some shipping companies can still count on fixed charter contracts to keep their vessels sailing, but in the spot market conditions have been deteriorating rapidly. So far charter rates have fallen by 14% since the start of the year as a result of the coronavirus.

In a recent interview with PCJ, managing director Andreas Rolner of United Heavy Lift said: “We have some fixed charter contracts that keep part of our fleet occupied, like the South Flank mining project of DK Schenker and BHP and the development of the Yunlin offshore wind farm in Taiwan. It’s worse in the spot market where rates have fallen significantly. All in all, we haven’t seen a good month yet in 2020. First, we had the Lunar New Year, than Covid-19 began causing problems in China and now it is affecting Europe. In general, it is a matter of time with delays putting pressure on schedule.”