Recession not as bad as initially feared

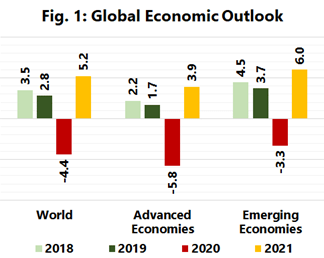

Although the global economy is still predicted for a recession in 2020, the intensity of it is now lower than previously anticipated, analysis of the IMF projections by shipping consultant SeaIntelligence shows. Compared to June, the revised global economic projections are up by 0.8 percentage points.

This means that the global economy is now projected to shrink by -4.4% in 2020, compared to an expected -5.2% contraction in June. The expected recovery in 2021, howver, has been revised downwards by -0.2 percentage points to a growth of 5.2%.

For 2020, the advanced economies were revised upwards by a significant 2.3 percentage points, which means that although they are still predicted to be in a severe recession of -5.8%, it is not as bad as initially feared. “Part of this could be explained by the exceptionally strong Transpacific demand especially on the US West Coast”, SeaIntelligence states. Although the IMF have revised the 2020 economic projections upwards, they have also revised the 2021 projections downwards by -0.9 percentage points.

World Trade

The outlook for world trade has also improved since June with positive revisions across the board. World trade in 2020 was revised upwards by 1.5 percentage points to a contraction of -10.4%. Imports by the advanced economies were revised upwards by 1.7 percentage points to -11.5% while exports by the advanced economies were revised upwards by 2.0 percentage points to -11.6%. Imports by the emerging economies were unchanged at -9.4% and exports by the emerging economies were revised upwards by 1.6 percentage points to -7.7%.

“While both advanced and emerging economies are predicted to have a strong recovery in 2021, we need to be mindful that growth in 2021 will come from a lower 2020 base and any recovery would therefore be amplified”, says SeaIntelligence.