Oil majors are bringing in money like never before

Listed oil majors are bringing in cash at the best rate ever witnessed even though oil prices have only partially recovered from the huge drop suffered in 2014 and 2015, according to Norwegian consultancy firm Rystad Energy. And “2019 could turn out to be another blockbuster year.”

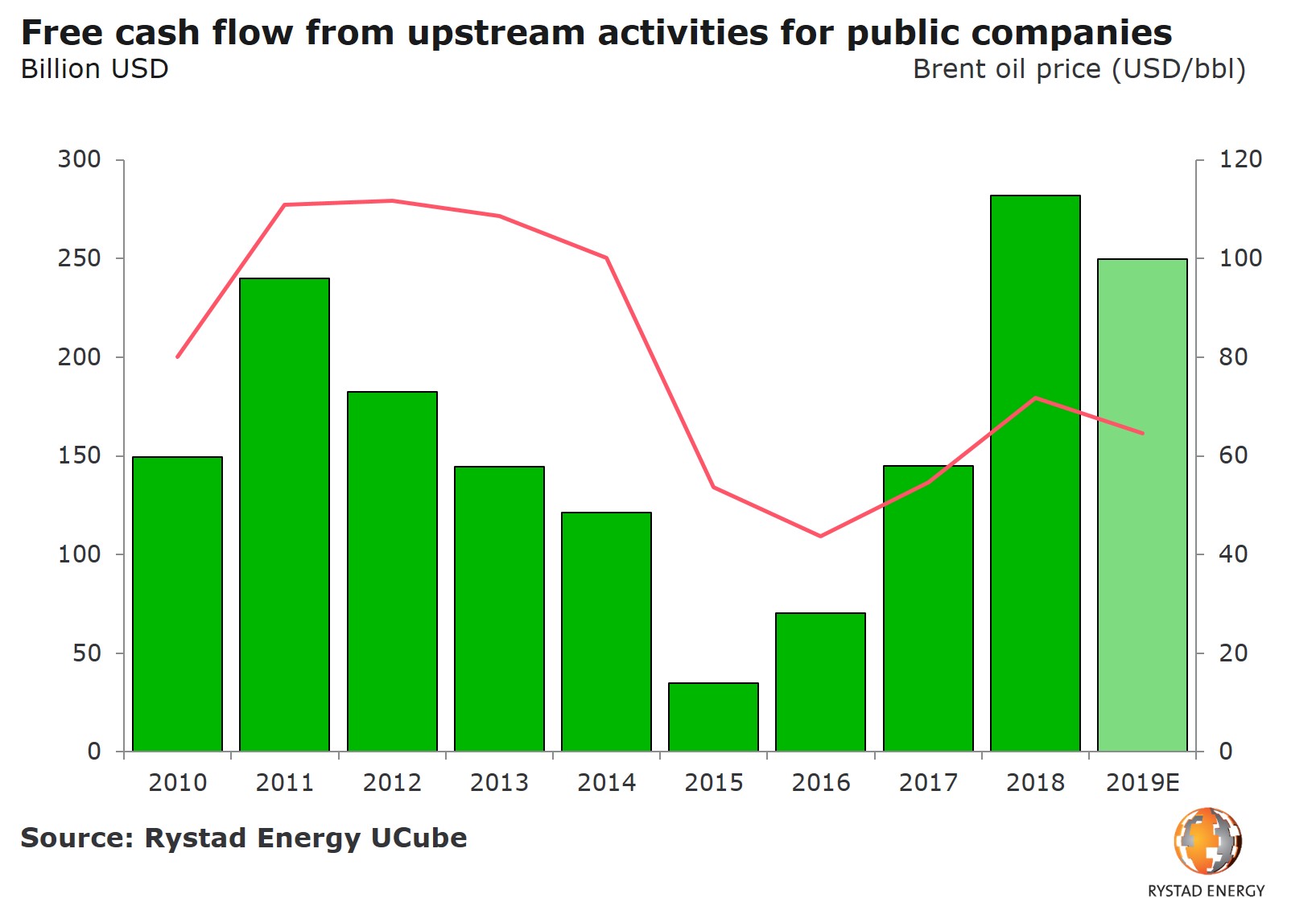

The oil companies saw their free cash flow for public exploration and production (E&P) skyrocket to almost $300 billion last year, marking the return of the “super profit” for industry majors.

“The fact that E&P companies are able to deliver the same shareholder returns despite much lower oil prices points to an impressive increase in profitability,” says Espen Erlingsen, Head of Upstream Research at Rystad Energy.

Rystad Energy analyzed the free cash flows of the world’s publicly listed oil companies since 2010. The numbers show a peak of the free cash flow in 2011 and then a gradual decline in the years between 2012 and 2014 as investment budgets increased and more money was spent on exploration and production. It took a huge hit in 2015 as the oil price collapsed but has since been gradually recovering. In 2018 that recovery speeded up and free cash flow almost doubled to the all-time high we see today.

“Our analysis of the latest annual reports from the majors clearly indicates that ‘super profits’ are back for large E&P companies. Free cash flow before financing activities was at a record high in 2018, and the mega profits were typically used to pay down debt and increase payments to shareholders,” Erlingsen said.

Article continues below image.

Lower activity

For 2019, Rystad Energy believes the high free cash flow for E&P companies will continue, hinting that this could be another blockbuster year for these players. That isn’t necessarily good news for the project cargo market as the improved profits are partially driven by lower investment activity. According to the analysts, global upstream investments have fallen from $900 billion in 2014 to around $500 billion now.

Two other driving factors for the improved profits are the higher oil prices (Brent oil currently stands at $69/barrel) and lower costs. Since 2014 the cost of developing new projects has fallen on average by 30%.

70 cents on the dollar

It is the shareholders who benefit the most from the high profits. Looking at the returns of the oil majors and Norway’s Equinor, cash from operations was $211 billion in 2018 while investments totaled $117 billion, leaving a profit of $94 billion before financing. Out of this, $25 billion was spent on reducing debt, while $69 billion was paid as dividends to shareholders, Rystad Energy notes.

“This means that almost 70 cents for every dollar in profits generated last year for these companies ended up in shareholders’ pockets,” Erlingsen remarked.

You just read one of our premium articles free of charge

Register now to keep reading premium articles.