Baker Hughes sees LNG orders increase by 32%

General Electric’s oil field services provider Baker Hughes beat expectations for the second quarter thanks to strong growth in the LNG market. The company booked USD 6.6 billion in orders and recorded an operating income of USD 361 million, up 25% year-on-year.

Baker Hughes is one of the largest suppliers of equipment to the oil and gas industry. Its business consists of four segments consisting of Oilfield Services, Oilfield Equipment, Turbomachinery & Process Solutions and Digital Solutions. The company was able to recorded growth in three of those segments, with Oilfield Equipment being the exception.

“We delivered a solid second-quarter 2019 both commercially and operationally. The trends for our longer-cycle businesses remain intact. The Liquefied Natural Gas (LNG) new-build cycle is a strong positive for our company and our international Oilfield Services business continues to be very successful,” said Lorenzo Simonelli, BHGE Chairman and Chief Executive Officer.

Total revenue of the company amounted to USD 6 billion. With an income of USD 3.2 billion, Oilfield Services is the largest business segment of the company, followed by Turbomachinery & Process Solutions which accounted for USD 1.4 billion in revenue.

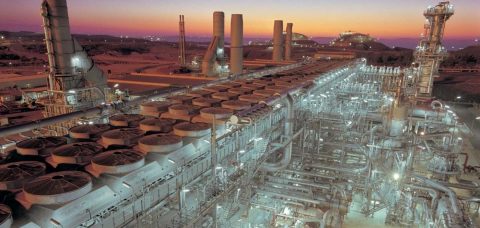

LNG

Looking at order intake, however, Turbomachinery & Process Solutions is currently the fastest-growing segment with orders up 32%. The growth to almost USD 2 billion in orders was driven by the LNG market.

“In Turbomachinery & Process Solutions, the second quarter saw the acceleration of activity in the LNG market. We have seen approximately 60 million tons per annum (mtpa) of new capacity reach Final Investment Decision (FID) since the fourth quarter of 2018, and the industry is on track to reach the 100 MTPA we outlined by the end of 2019. Also in the quarter, we delivered strong orders in our on- and offshore production segment, securing important wins in India and Africa. We remain well-positioned across multiple market segments, most importantly LNG, as more projects move towards positive FID this year,” Simonelli said.

In a conference call about the second-quarter results, the CEO brushed off concerns that issues around global economic growth and tariffs stemming from the trade war could slow investment decisions over the next year.

“As you look at demand, Chinese LNG ports continue to grow. You got South Korea continuing to grow, India continue to grow,” he said according to Reuters.

In total, the company’s orders were up 9% year-on-year to USD 6.6 billion. Next to strong growth in Turbomachinery & Process Solutions, Baker Hughes also recorded a growth of 14% in its Oilfield Services business portfolio.

The quarterly results confirm conclusions of various analyst firms, who are expecting the oil and gas market to recover and the LNG market to grow rapidly in the next few years.

You just read one of our premium articles free of charge

Register now to keep reading premium articles.