Media: Saipem and Subsea 7 consider merger

Saipem and Subsea 7 are considering to merge to weather the still difficult circumstances in the oil and gas services market. If the deal goes through, it would create the fourth-largest oilfield service company, after Schlumberger, Halliburton and Baker Hughes.

No final decisions have been made yet and there’s no certainty the talks will lead to a transaction, reports Bloomberg citing confidential sources. The two offshore contractors have been in merger talks before in previous years but failed to reach an agreement.

If the companies find common ground this time, the merger would create one of the biggest offshore contractors in the world. Norway-listed Subsea 7 operates a fleet of 34 survey and construction vessels including the well known heavy-lift vessels Seaway Strashnov, Seaway Yudin and Seven Borealis, while Italian Saipem owns and operates a large and diversified offshore fleet including drill rigs, heavy-duty barges, FPSO’s, 11 (subsea) installation vessels and the ultra-heavy-lift ship Saipem 7000, which is capable of lifting 14,000 tonnes.

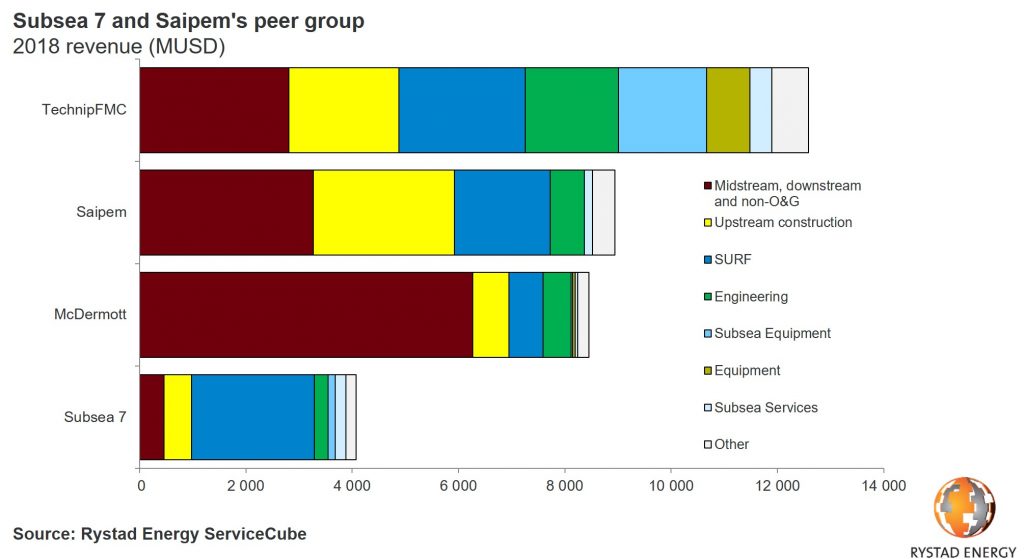

“A deal would create a truly global oilfield service giant with over $12.4 billion in revenue. The combined entity would have the world’s largest fleet of subsea installation vessels and be the largest provider of SURF services (construction and installation of subsea umbilicals, risers and flowlines, ed.) with a market share of close to 40%”, says Audun Martinsen, head of oilfield service research at Rystad Energy, in response to the unconfirmed reports.

He added that Rystad Energy is seeing clear signs of consolidation, diversification and alliance formation in the sector. “Oilfield service companies are looking to strengthen their market share in core markets but also develop new lines of business. Both Saipem and Subsea 7 have stated goals of de-carbonization in order to become greener energy service companies,” Martinsen remarked.

By combining with Saipem, Subsea 7 would also get exposure to onshore engineering and construction, where Saipem has a solid track record in the petrochemical and liquefied natural gas industries, thus reducing dependence on upstream oil and gas activities.

Oil price

The oil and gas markets are recovering much slower than anticipated following the crash of crude prices in 2014. The price of Brent oil has dropped 28% since its most recent peak in October last year and analysts like Drewry expect the oil price to be below 60 dollars per barrel on average in the next few years. This has driven EPC-contractors to further cut costs and seek synergies in order to weather the prolonged downturn.

Despite the challenges, Saipem reported improvements both in revenue and profit over the first nine months of 2019. Revenue amounted to EUR 6,7 billion, which is an improvement of EUR 700 million compared to the same period last year. The operating profit (ebit) improved tenfold from EUR 43 million to EUR 402 million.

On November 14th, the company announced it had secured another EUR 880 million in contracts. Saipem also just signed a strategic cooperation agreement with Daewoo E&C with a focus on onshore LNG projects.

Subsea 7 last week reported lower income than last year. The company saw its revenue decrease by 9% to EUR 2.7 billion, while its operating profit was almost slashed in half and decreased from EUR 177 million over the first nine months last year, to EUR 93 million in 2019.

You just read one of our premium articles free of charge

Register now to keep reading premium articles.