Can MSC’s bid change HHLA’s fortunes?

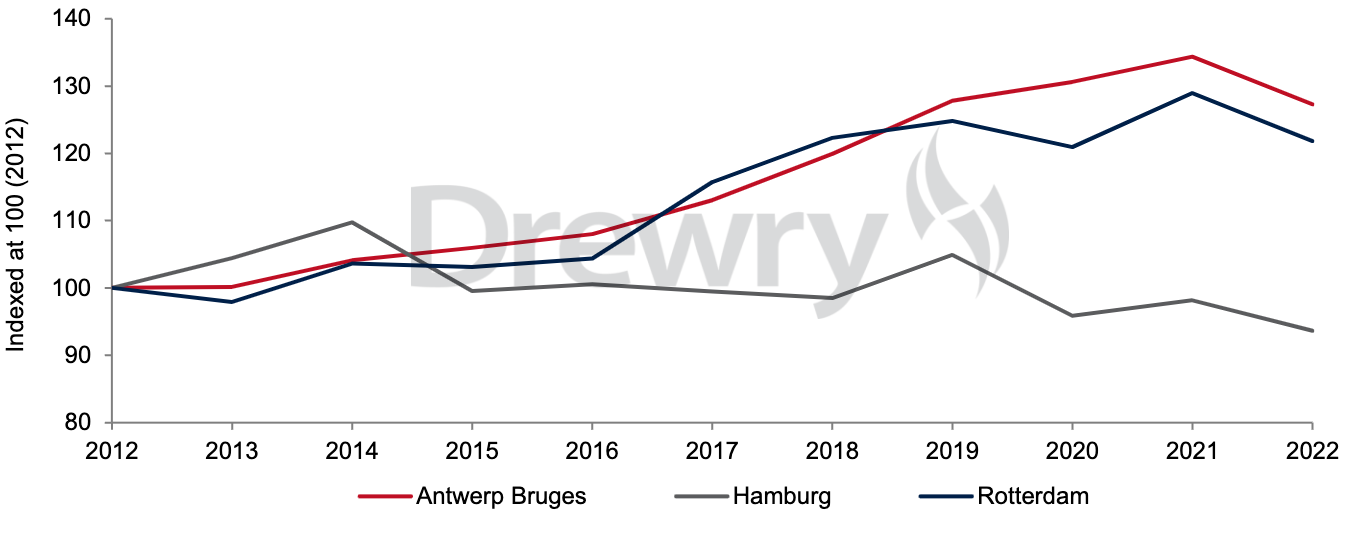

Unexpected as it may have been, the offer made by the Mediterranean Shipping Company (MSC) to buy a major stake in Hamburger Hafen und Logistik Aktiengesellschaft (HHLA), could potentially turn around the fortunes of the company that has been losing market share to the likes of Rotterdam and Antwerp.

Under the agreement between MSC and the City of Hamburg, the former would move its headquarters to Hamburg and bring at least 1,000,000 TEU per year from 2031 onwards. It is a welcome sign, according to a recent insight by the shipping consultancy Drewry.

A closer look

MSC plans to purchase all publicly traded A shares of HHLA at a price of €16.75 per share, offering a substantial premium of 57 per cent over the 30-day volume-weighted average price. This move closely follows German billionaire Klaus-Micheal Kuehne’s expression of interest in acquiring the German port company.

Drewry explains that HHLA has two different classes of shares, Class A and Class S. Class A shares, which are publicly listed on the Frankfurt stock exchange, grant shareholders the right to participate in the financial results of its Port Logistics subgroup.

Conversely, class S shares represent the company’s Real Estate subgroup, and unlike their class A counterparts, are not publicly traded on the stock exchange and are exclusively owned by the Free and Hanseatic City of Hamburg (FHH) – which is also a majority owner (69 per cent) of the company’s class A shares (Ports Logistics subgroup).

If the deal goes through, HHLA will become a joint venture between FHH (50.1 per cent) and MSC (49.9 per cent); and will be delisted from the market.

Port assets appeal

Port assets hold significant appeal for long-term investors due to their consistent cash flow patterns. Recently, ports have captured the interest of container shipping companies, which are actively exploring diversification opportunities along the entire shipping value chain, particularly in response to the challenges faced in their core ‘shipping’ operations, according to Drewry.

Given the prevailing global macroeconomic challenges, persistent inflationary pressures and uncertain consumer confidence, the prospects for substantial improvement in the near future appear dim. Nevertheless, despite the downturn, shipping companies find themselves in possession of substantial cash reserves amassed during the 2020-21 super-cycle.

The proposed deal has brought respite to HHLA, the volumes of which had largely stagnated in the past because of the tough competition from its regional peers and the recent lower cargo volumes in the Far East, particularly China. The company has been losing market share to its European peers of Rotterdam and Antwerp, which are primarily benefitting from the implicit volume support of liners because of their ownership at the terminal level.

In such a scenario, MSC’s pledge to bring in additional yearly volumes of 1 million TEU (by 2031) is a welcome move for HHLA. Furthermore, as part of the deal, MSC plans to move its German headquarters to Hamburg, creating fresh employment opportunities for the residents of Hamburg. This shift has been well-received by the local government, particularly amid increasingly sombre macroeconomic forecasts.

MSC has confirmed that it will present the offer document to the German Federal Financial Supervisory Authority (BaFin) for review in the coming four weeks. Despite the recent disagreement concerning the sale of the minority stake in one of HHLA’s terminals to COSCO, which may suggest a rigorous approval process, the deal’s intra-European nature is expected to work in their favour.

Read also: Hapag-Lloyd goes on about its business, HHLA offer not interesting

HHLA stock price edges up

After the announcement, HHLA’s stock price surged by a remarkable 49 per cent in just one day, reaching €17.20 (above the MSC’s bid of €16.75), but it is worth noting that the company’s stock price is approximately 70 per cent lower than its IPO listing price on November 2, 2007.

At its current trading price, HHLA’s EV/EBITDA ratio is estimated at 5.3x, a substantial increase from 4.6x calculated just before the announcement. However, it still lags behind the average EV/EBITDA ratio of globally listed port players, which stands at 11.7x, despite HHLA’s extensive intermodal reach to Central and Eastern Europe.

According to Drewry, the present situation strongly suggests the likelihood of German billionaire Klaus-Michael Kuehne making a counteroffer, who has already expressed interest in the asset, but only time will tell whether Klaus-Michael Kuehne makes a counteroffer.

You just read one of our premium articles free of charge

Want full access? Take advantage of our exclusive offer