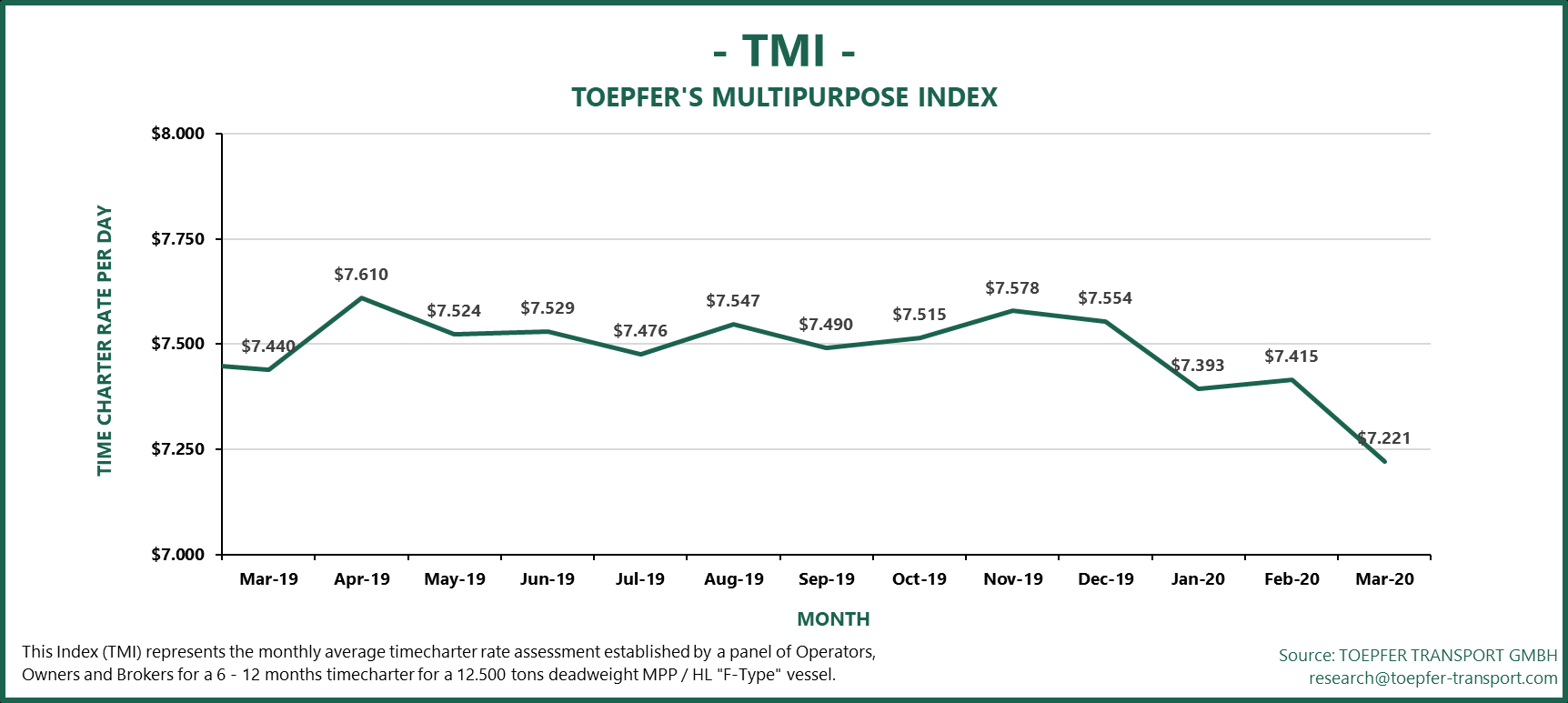

Charter rates start to slide as coronavirus spreads

The charter rates for multipurpose vessels are starting to slide as a result of lower demand caused by the coronavirus. The average day rate for a 12,500 dwt MPV/HL vessel dropped with nearly 200 dollars in March to USD 7,221, data from Toepfer’s Multipurpose Shipping Index shows.

In February, the average day rate actually increased a little in comparison with January and stood at USD 7,415, but with the rapid spread of the coronavirus to Europe and other parts of the world, prices have now begun to drop.

The sharp decline in fuel prices does provide vessel owners and operators with some relief on the cost side which will help to cushion the blow. As a result of the coronavirus and the oil conflict between Saudi Arabia and Russia, prices for low sulphur fuel oil dropped dramatically from nearly USD 600 to just over USD 300 per barrel in the port of Rotterdam.

Demand growth diminished

The outbreak of the virus is causing serious disruptions in supply chains and is currently uncertain how the situation will play out.

One likely scenario according to Drewry is that China manages to contain the virus before the start of the second quarter but the virus will spread more rapidly in other countries. This is the pattern that is currently being reported around the globe. In China, factories are slowly beginning to pick up production again, while Italy has effectively shut down its country after the number of infections and casualties rose sharply at the start of the week.

Drewry believes that this development will result in a bigger slowdown of GDP growth and possibly even a contraction of the global economy, with the recovery being pushed into 2021 and likely being smaller in scale. For MPV-operators, the reduction in dry cargo demand and the increased competition from bulk and container shipping will result in weaker demand and freight in 2020. Silver lining is that the previously forecast breakbulk and project cargo slump in 2021 will be less severe.

You just read one of our premium articles free of charge

Register now to keep reading premium articles.