Pandemic drives up vessel operating costs

PRESS RELEASE – Vessel operating costs have risen at their fastest pace in over a decade this year due to higher insurance cover premiums and Covid-19 related expenses. Yet, they are expected to moderate in subsequent years as pandemic related spend unwinds, reports Drewry.

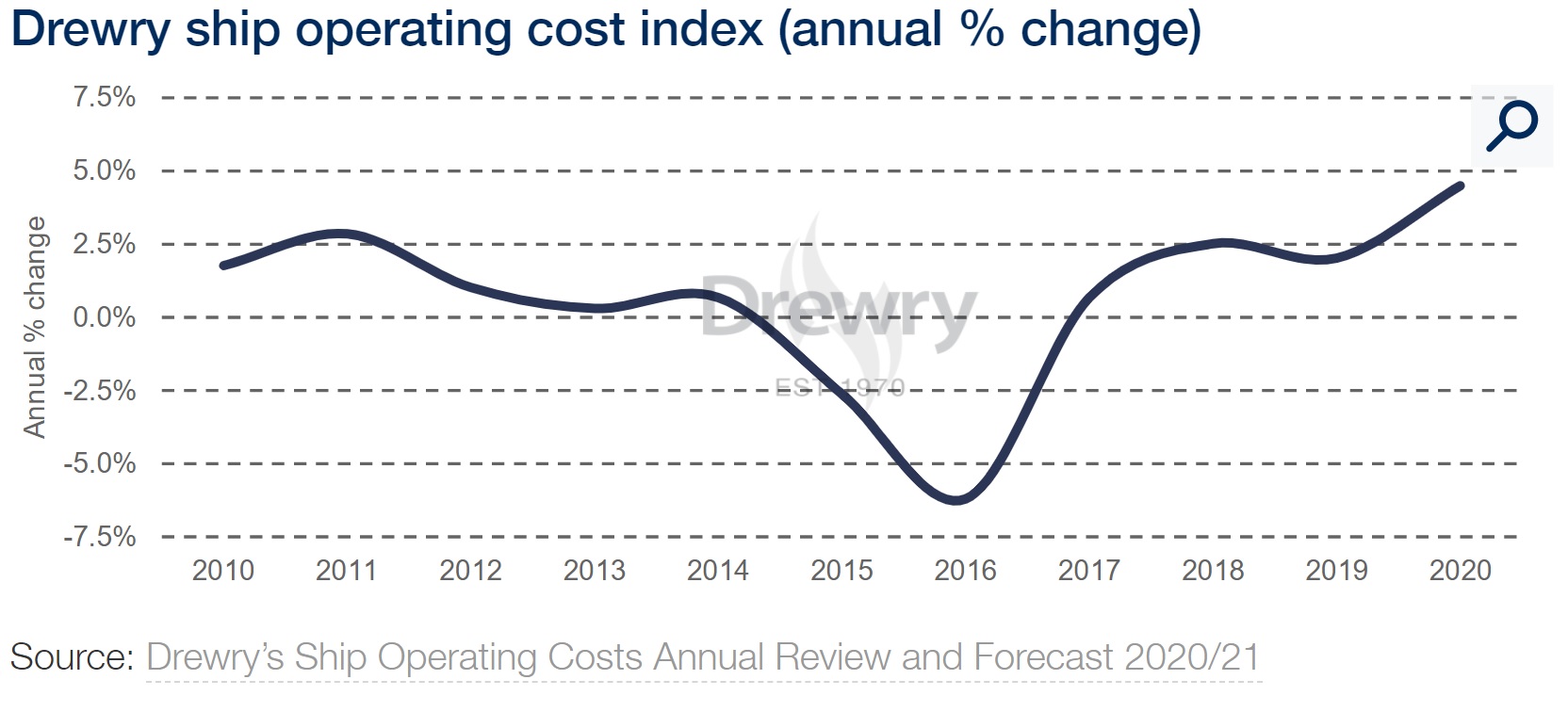

Drewry estimates that average daily operating costs across the 47 different ship types and sizes covered in the report jumped 4.5% in 2020, compared to underlying increases of 2% and 2.5% respectively in the previous two years. This followed a period in which OPEX spending stagnated or contracted over three consecutive years by 8% in 2015-17 (see picture above).

“Like many aspects of merchant shipping, vessel operating costs have been severely impacted by the Covid-19 pandemic”, says Drewry’s Director of research products Martin Dixon. “Its effects cut OPEX spend through the first half of the year as economic lockdowns and social distancing restrictions closed dry-docking and repair yards, while owners reacted to the resultant trade downturn by postponing anything except essential spend. However, costs have jumped through the second half of the year as repair facilities reopened, unleashing pent-up demand, while manning costs escalated due to disruption to crew repatriation arrangements.”

Manning costs

Manning costs were particularly impacted, climbing 6.2% in 2020 compared to underlying rises of 1.3%, while hull and machinery (H&M) and protection and indemnity (P&I) cover costs jumped 4.5% on a hardening insurance market. Meanwhile, disruption to supplies and labour availability caused by the pandemic pushed stores and spares and repair and maintenance cost inflation to around three per cent, while dry-docking spend leapt 5%.

The rise in costs was broad-based across all the main cargo carrying sectors for the third consecutive year, as all ship types took the hit from Covid-19. The latest assessments include vessels in the container, chemical, dry bulk, oil tanker, LNG, LPG, general cargo, reefer, roro and car carriers’ sectors.

Conditions to remain challenging

Looking ahead, trading conditions are expected to remain challenging, dominated by Covid-19 induced trade uncertainties and continued overcapacity in many sectors, which will keep a lid on OPEX spend.

“Ship operating costs are expected to moderate in 2021, as some one-off Covid-19 related costs unwind in response to containment responses, offsetting inflationary pressures elsewhere”, adds Dixon. “Thereafter, we expect opex inflation to return to past trend, rising below the general rate of price inflation and so representing cost stagnation in real terms, although there will be variations by cost head.”

You just read one of our premium articles free of charge

Register now to keep reading premium articles.