Drewry lifts MPV Index as rates slowdown is short-lived

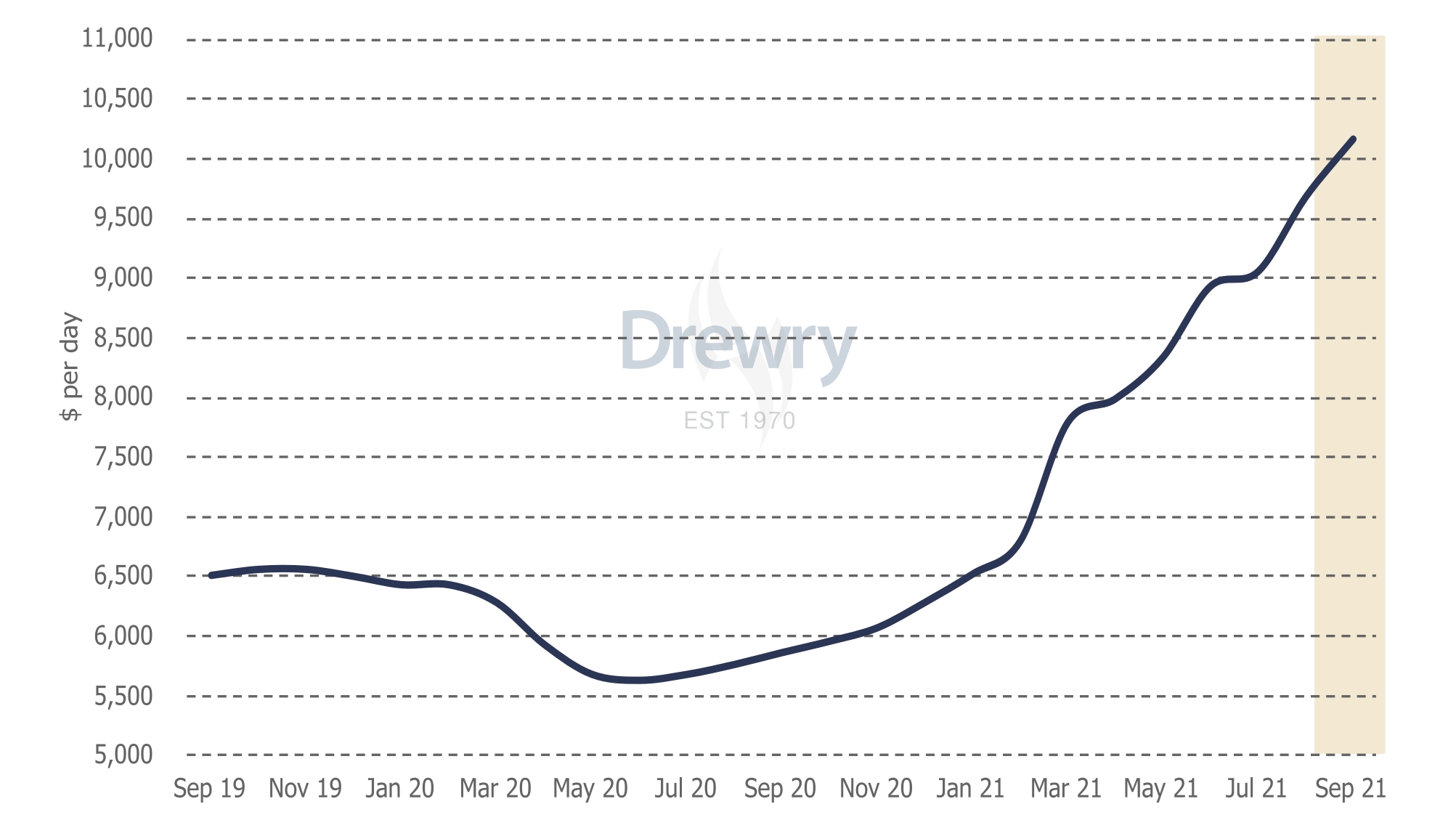

The Drewry Multipurpose Time Charter Index (MPV Index) jumped almost 7 percent in August, beating the shipping consultancy’s forecast of a slower rise. To remind, the shipping consultancy Drewry expected the index to edge up just over 1 percent from July figures.

In its latest report, Drewry informed the Index jumped to $9,679 per day in August, above the $9,200 predicted last month. The August figures represent a rise of almost 7 percent compared to the 1.4 rise seen in the previous month, as the usual summer lull came to an abrupt end. Drewry’s Index is up 48 percent since the start of the year and 67 percent since August 2020. Drewry expects the index to rise a further 5 percent in September to reach $10,165 per day.

Less heavylift capable vessels slowed July MPV Index growth

The slower rate of growth exhibited by the MPV Index over July was largely due to a softening in the market for smaller, less heavylift capable vessels. It should be noted that this Index is a weighted average of the two main sectors and the weaker (less heavylift capable) sector has adversely affected the Index over the last two months, Drewry said in its report.

However this year’s summer lull was particularly short-lived for the shortsea market and by the second half of the month a pickup in demand, particularly in the Mediterranean and Black Sea ports was already noticeable. This resulted in an uplift of around 1.5 percent in rates for the smaller vessels in the fleet over August.

Meanwhile the project carrier and heavylift capable vessels continued to enjoy a rising market. Vessel availability was scarce, as the majority of ships have been fixed well into the second half of 2021, and demand continued to climb as the capacity constraints and equipment shortages continued in the competing sectors, making these vessels the go-to choice for a number of shippers, with charter rate growth for this vessel type of over 10 percent month-on-month. Drewry does not expect the supply – demand balance to change significantly in the short-term, leading to further growth in charter rates and a rising Index into September.

You just read one of our premium articles free of charge

Register now to keep reading premium articles.