Drewry: new lockdowns in China halt multipurpose vessels rates drop

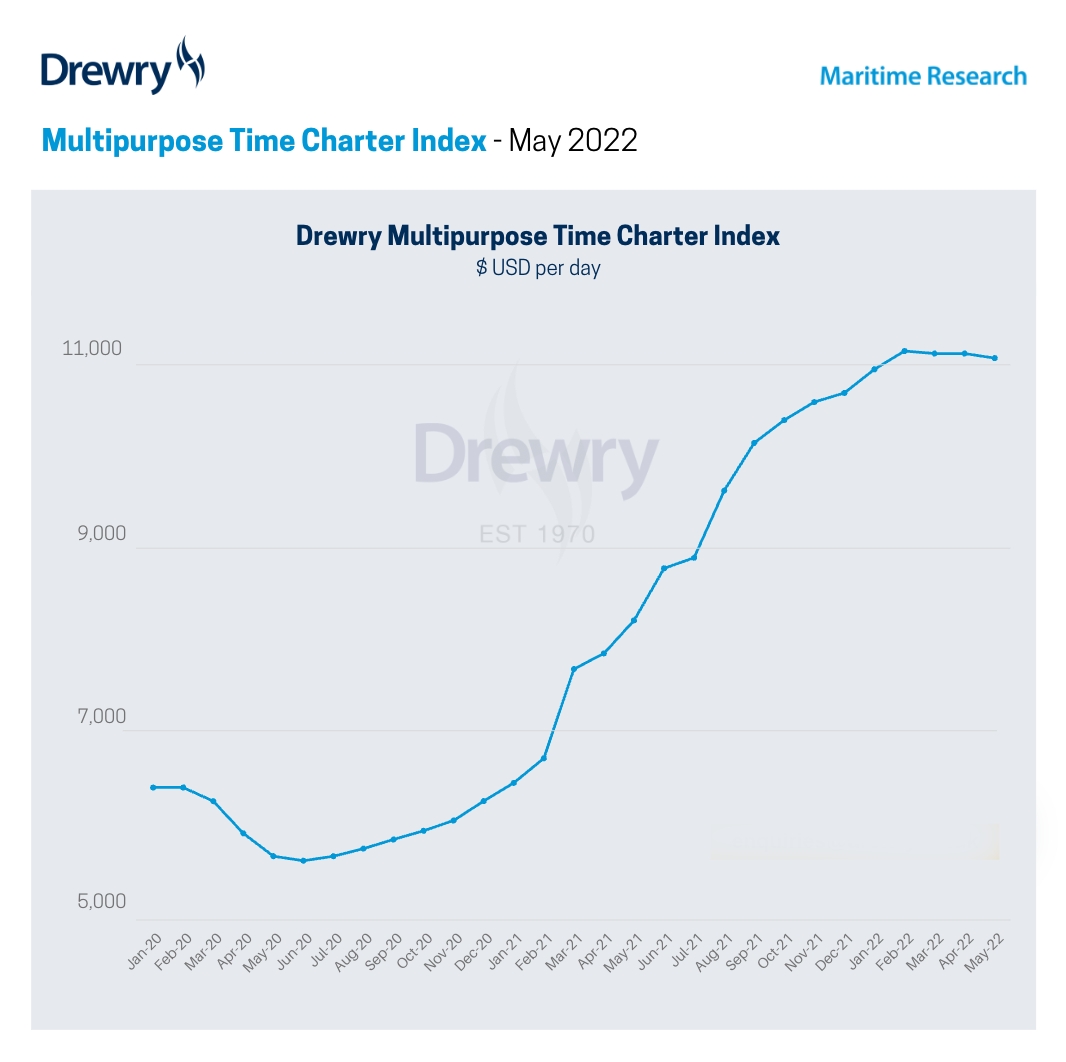

Charter rater for the multipurpose vessels remained flat during the month of April, as new Covid lockdowns in China stopped the downwards trajectory. However, shipping consultancy, Drewry, expects its Multipurpose Time Charter Index to slip slightly again in May.

During the month of April, Drewry’s Multipurpose Time Charter Index stopped at $11,170 per day, flat compared to the previous month. While the consultancy expected the softening of the rates to continue in April, China’s Covid restrictions and extended Easter holidays in Europe postponed the rates softening.

“Going forward we expect the weakening trend to return in May with the Index dropping, albeit by less than 0.5 percent to $11,120 per day,” the report says.

April has been characterised by a wait and see approach from shippers as various Easter holidays produced a month of stop-start activity. Add to this the impact of Chinese lockdowns on both port operations and manufacturing output, the ongoing conflict in Ukraine taking the Black Sea market to new depths and sky-high fuel prices.

Going forward into May and the likelihood is the pent-up demand in China should support the longer haul, heavy lift sector, however will that be released in time to affect this month’s spot rates? We think that is unlikely and container rates will continue to soften. The driving factor for the MPV market over the last 12 months has been the spill over cargo from the container sector, whether that is containers themselves or commodities that have moved back to breakbulk.

Over the next month Drewry expects the ongoing weakness in the Handy sector will help to keep spot rate rises subdued, as they add to the competition for breakbulk cargo, however there may be a renewed rate growth over the summer as China comes back online.

You just read one of our premium articles free of charge

Register now to keep reading premium articles.