Scrapping candidates appear here and there in the multipurpose sector

With the time charter rates for the multipurpose vessels (MPV) falling since the previous year’s high levels, operators are now looking to send older vessels in their fleet for demolition. During the peak charter rates, these vessels have also been able to find employment.

In its recent opinion, Drewry analysts say that in the near future demolitions will increase, however, the low orderbook indicated that the supply of vessels could tighten with growing demand, reducing the number of candidates for demolition.

Robust demand for moving project cargo will continue to support multipurpose (MPV) shipping, enabling charter rates to remain substantially above pre-pandemic levels, in contrast with the competing sectors of dry bulk and container ships.

But these projects are not suitable for all ships that fall within the MPV category. As a result, the demolition candidates are mainly the larger MPVs with low crane capacity, which have found themselves competing for cargoes with container and dry bulk carriers. Smaller vessels, Project and Premium Project Carriers will able to find employment much easier based on our vessel demand forecasts.

Yearly demolitions well below historical levels

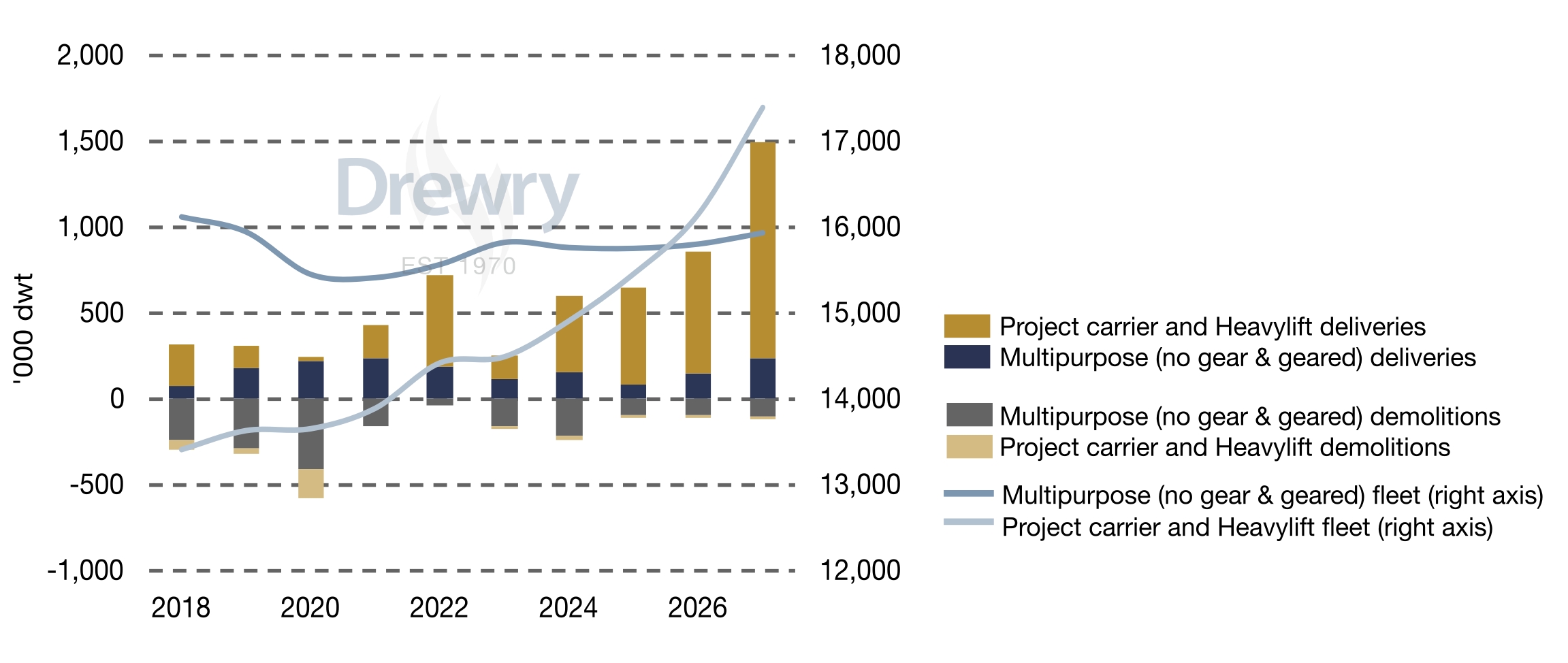

Drewry analysts note that yearly demolitions have already reached 91,000 dwt, of which 67,000 dwt were MPVs of low crane capacity. “Our expectation is for this figure to more than double by the end of 2023 and increase by a further 35 per cent in 2024,” analysts say.

The number of demolition candidates is low by historical levels, when considerinf years like 2015 when demolitions reached 809,000 dwt, followed by 516,00 dwt in 2016 and 552,000 dwt in 2017. Scrapping levels have decreased since then, with the exception of 2020 when covid-19 lockdowns caused a sudden drop in vessel demand. The increase seen this year and projections for the 2024 are still low by historical standards.

Drewry expect demolition candidates to decline again after 2024, due to low numbers of deliveries bringing a tightness in supply. In 2025, an increase demand and vessel utilisation is expected. This will bring an increase in TC rates, the lack of supply will most likely result in operators still finding employment for vessels which would otherwise be sent for demolition, hence reducing the number of demolition candidates.

Read also: Headwinds for Russian multipurpose sector may bring positives elsewhere

You just read one of our premium articles free of charge

Register now to keep reading premium articles.