Subdued summer in the MPP sector

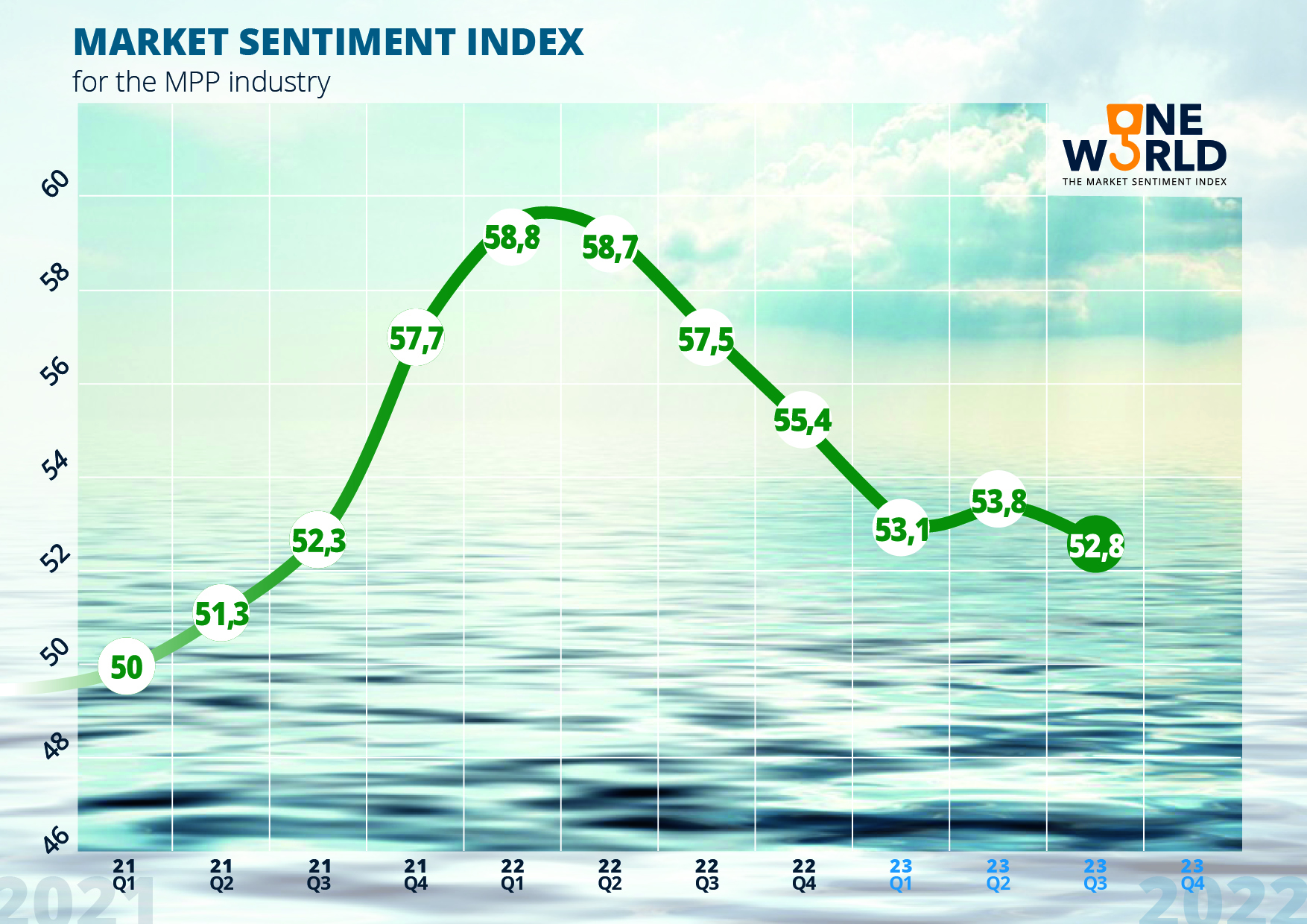

Following the first uptick since the first quarter in 2022, the Market Sentiment Index, an indicator of activity in the MPP industry, has slipped again.

However, in the tenth edition of the MSI, readied by the Hamburg-based specialised shipbroking house One World Shipbrokers, the sentiment of confidence in the short-term markets, backed by expectations of improvements later in the year, has continued.

“Whilst the overall index has slipped to 52.8 it is again the short-term weighing more heavily than the longer term especially in Asia and North America. This compares to an MSI of 53.8 reported in the 9th edition of the index.

Traditionally the summer months in the northern hemisphere is a softer trading period and with the breakbulk market having fallen precipitously from the stellar highs of 2022 the combination of the summer vacation season and the correcting market, sentiment in the MPP sector has reason to be subdued,” One World Shipbrokers report reads.

Overoptimistic view of the long-term

Several carriers have cited the weakness in the handy and container markets and the cross trades – now more evident than earlier in the year – as the main drag on the short term MPP market. Yet owners are generally unwilling to reference today’s levels for anything other than short term TC business believing in the accumulating narrative that the MPP sector is going to significantly benefit from an increasingly active project sector led by a resurgent wind business, One World Shipbrokers say.

That said, several carriers have expressed some caution against over optimism and whether the future can match anticipation. Nevertheless, with the newbuilding book still at very low levels and the impact of the incoming EU emissions regulations (ETS) likely to drive some older or less capable vessels out of service – or out of range – there can be no case made for an influx of new MPP tonnage upsetting current supply either in the long or short term. Demand is the driver.

The sentiment outlook should therefore remain relatively stable with near term confidence levels likely to remain in a narrow range before the higher activity levels of the year’s latter months kick in and likely lead the index higher, the shipbroker say.

You just read one of our premium articles free of charge

Register now to keep reading premium articles.