Could China’s multipurpose vessel orderbook dominance spell trouble?

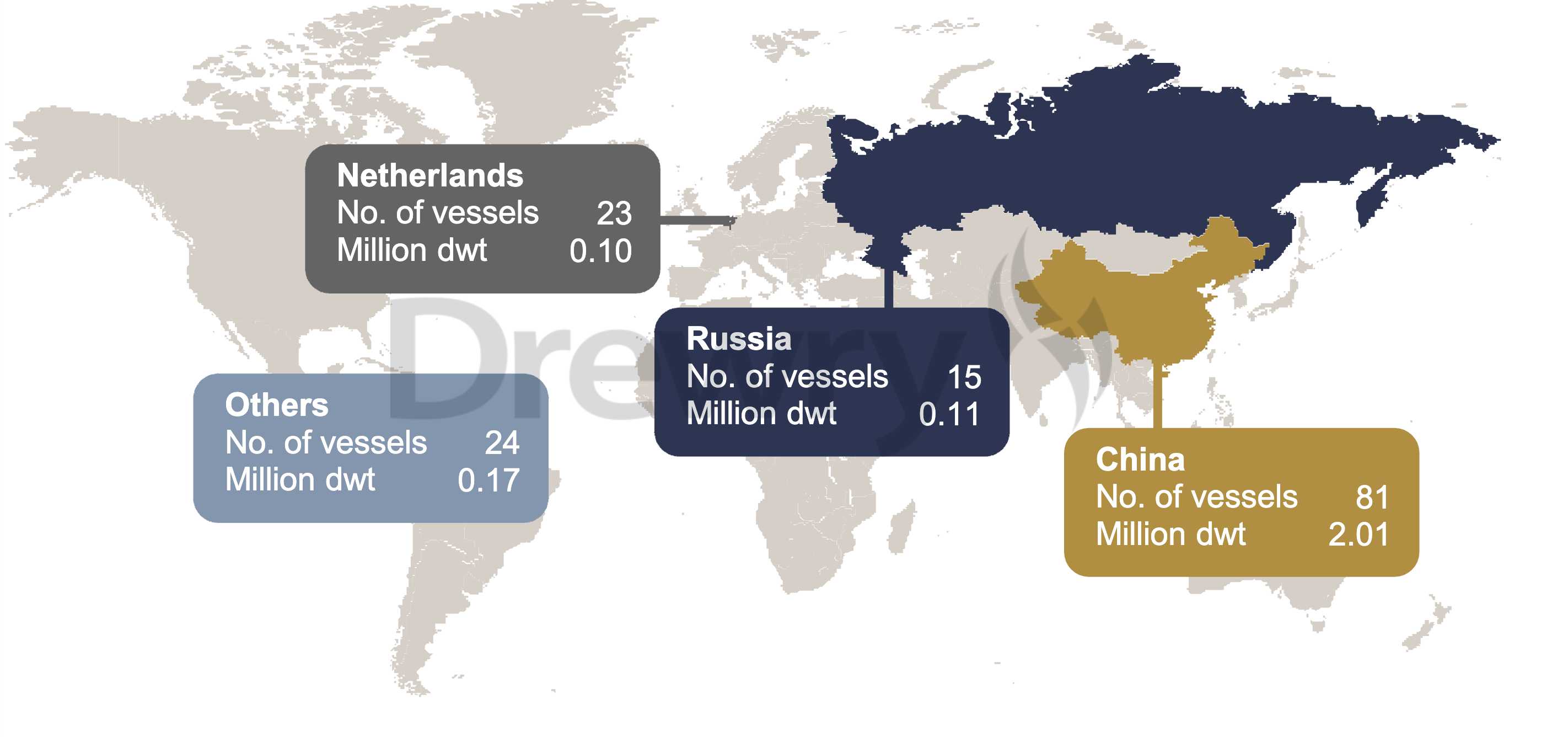

The multipurpose vessel (MPV) orderbook to date is dominated by China, both in number of vessels and total dwt, Drewry’s analysts say. At the same time, China has exclusively been building all the high-capacity ships of the sector. While this is not a new development, the growing geopolitical tensions between the US and China could put the MPV fleet expansion and charter market in a precarious position.

As discussed in Drewry’s Multipurpose Shipping Forecaster report, the multipurpose vessel orderbook is small, at just under 2.4 Million dwt. With the recent downturn in charter rates, the lack of expected oversupply has been a positive for vessel owners, unlike other sectors such as container ships. High vessel utilisation has kept multipurpose vessel charter rates above pre-covid levels which has encouraged some owners back to the newbuild market. Although higher rates may not be most appetising for charterers, a healthy charter market will encourage newbuilding activity, and in the long term stabilise rates as cargo demand increases, which Drewry expects to accelerate significantly from 2025. Hence, a larger orderbook is now required to keep pace with the anticipated trade expansion.

A fairly unique characteristic of the large-capacity multipurpose vessel segment is that these vessels have exclusively been built in China in the past 10 years or so, and the same applies to the current orderbook. While this was not an issue for several years, recent China-US tensions in relation to Taiwan, Chinese military activity in the South China Sea and the government’s stance on the Russia-Ukraine war increase the risk of trade sanctions or restrictions between China and the West. If this situation escalates, delayed vessel deliveries or even complete abandonment of certain contracts could become a possibility, depending on the severity of the situation, Drewry said.

While building large MPVs could be transferred to other countries, it would bring with it a significant delay in expanding the fleet from current levels. Only a few yards outside China have experience of building such vessels, and ordering MPVs in those yards located in Japan, South Korea and various European countries would not only see certain delivery delays but also substantially higher newbuild prices, according to Drewry.

While it is possible that rising geopolitical tensions have the effect of lowering international MPV cargo demand as exports are shifted to other countries, we expect demand for large MPVs to be robust in the second half of the decade, mainly driven by energy projects.

In conclusion, the combination of a small orderbook, robust charter market and no newbuild activity outside China could lead to particularly tight MPV market conditions if Chinese-Western tensions escalate.

You just read one of our premium articles free of charge

Register now to keep reading premium articles.