Forest product carriers take top spots in breakbulk top 10

Thanks to their fleet of large forest product carriers, G2 Ocean and Saga Welco take the top spots in the breakbulk operator top 10, according to Dynamar.

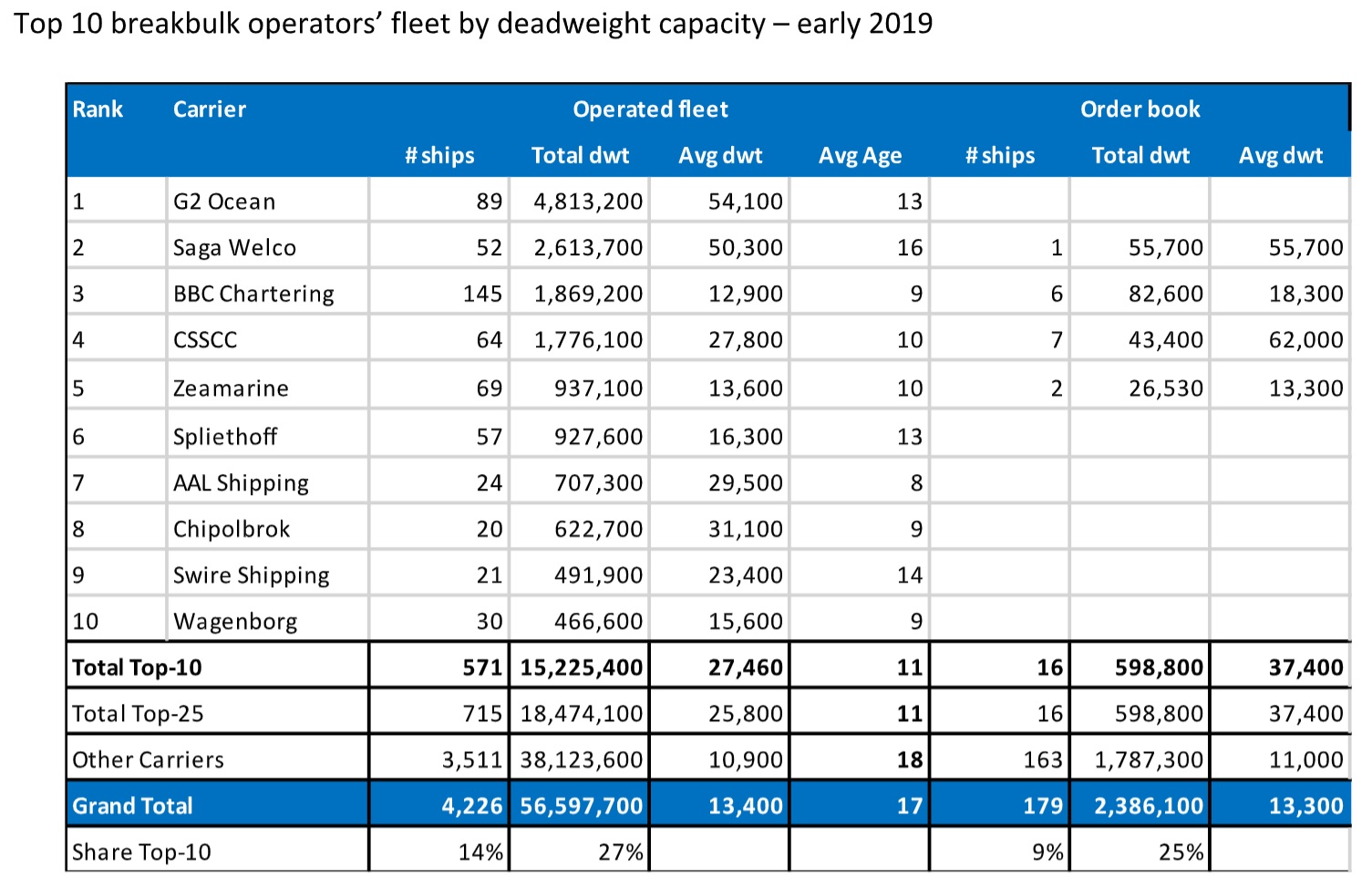

The Dutch analyst firm compared the multipurpose vessel operators based on the total deadweight tonnage of their fleets to see which operator has the largest cargo capacity.

Thanks to its large open hatch gantry crane vessels, which are way bigger than traditional multipurpose vessels, G2 Ocean takes the top spot by a large margin. According to Dynamar, the joint venture of Norwegian shipping companies Gearbulk and Griegstar operates a fleet of 89 vessels with a total deadweight of 4.8 million tonnes. G2 Ocean itself, however, says its total fleet is comprised of 130 vessels, of which 110 vessels are of the open hatch type. The fleet consists of a mix of owned vessels and ships on long term charters.

Either way, the company’s fleet is considerably larger than that of runner-up Saga Welco, which has a total capacity of 2.6 million tonnes divided over 52 vessels.

From the third position down, the breakbulk top 10 shows a more familiar picture with BBC Chartering leading the group of traditional multipurpose and heavy-lift shipping companies. The German carrier sits in the third position with a total deadweight of almost 1.9 million tonnes. BBC’s fleet exists of no less than 145 vessels with an average deadweight of 12,900 tonnes, clearly showing the difference with G2 Ocean’s fleet which has an average vessel size of 54,100 tonnes.

BBC Chartering is followed by Cosco SSC, Zeamarine, Spliethoff, AAL Shipping, Chipolbrok, Swire Shipping and Wagenborg. Looking at the fleets multipurpose vessel operators, Cosco SSC, AAL Shipping and Chipolbrok own significantly larger vessels than their direct competitors with an average ship size of 27,800, 29,500 and 31,100 tonnes, respectively.

Static fleet

Overall, the current multipurpose fleet consists of 4,700 ships with a total deadweight of 63 million tons. The fleet can broadly be split into two categories: those with ramps (ro/ro) and those without.

Newbuild activity in the sector is quite low. The order book consists of 236 units representing 5% of the operating fleet. This figure includes all vessels delivered or due for delivery in 2019.

Looking at the top 10, only four of the ten operators currently have ships on order. Cosco SSC has the biggest order book with seven heavy load carriers with an average deadweight of 63,000 tons. Next is BBC Chartering with six ships on order with a combined deadweight of 82,600 tons, followed by Zeamarine with two ships of 13,300 tons each and Saga Welco, which is expanding its fleet of forest product carriers.

Lift capacity

As Drewry previously also noted, Dynamar sees a clear trend towards vessels with a bigger lift capacity. Interestingly, HMM, with just four vessels, has the biggest average lift capacity with 640 tons, followed by Chipolbrok with 570 tons and Sinagpore’s AAL with 470 tons. In terms of average lift capacity, Zeamarine (395 tons) and BBC Chartering (380 tons) are number four and five. Looking at aggregate lift capacity however, BBC Chartering leads the list while Zeamarine holds the second position.

G2 Ocean and Saga Welco hold a 13th and 16th position in the lift capability ranking. “Indeed, the highest deadweight capacity does not necessarily equate to a high heavy-lift capability. The two Open Hatch Gantry Crane (OHGC) operators with the largest fleets in terms of deadweight have limited onboard-crane capacities,” Dynamar notes.

G2 Ocean will be one the speakers at the Project Cargo Summit, a two-day international conference about the transport of large and heavy cargoes, which is organised by Promedia Group on the 11th & 12th of September, 2019 in Rotterdam. The company will talk in detail about its recent blockchain bill of lading project. For more information about this dedicated project cargo and heavy-lift event, please visit www.projectcargosummit.com.

You just read one of our premium articles free of charge

Register now to keep reading premium articles.