Charter rates continue to shoot up sharply

Demand for multipurpose vessels is booming. The charter rates have shot up by 7.6% month on month to USD 8,902 on average, shows Toepfer’s Multipurpose Shipping Index. That is nearly 18% more than this time last year.

“The demand for cargo space is booming and so are the cargo enquiries for the next months. Large operators try to keep the tonnage they have and to add up more, causing only very few vessels to appear on the spot market”, says Yorck Niclas Prehm, head of research at Toepfer Transport.

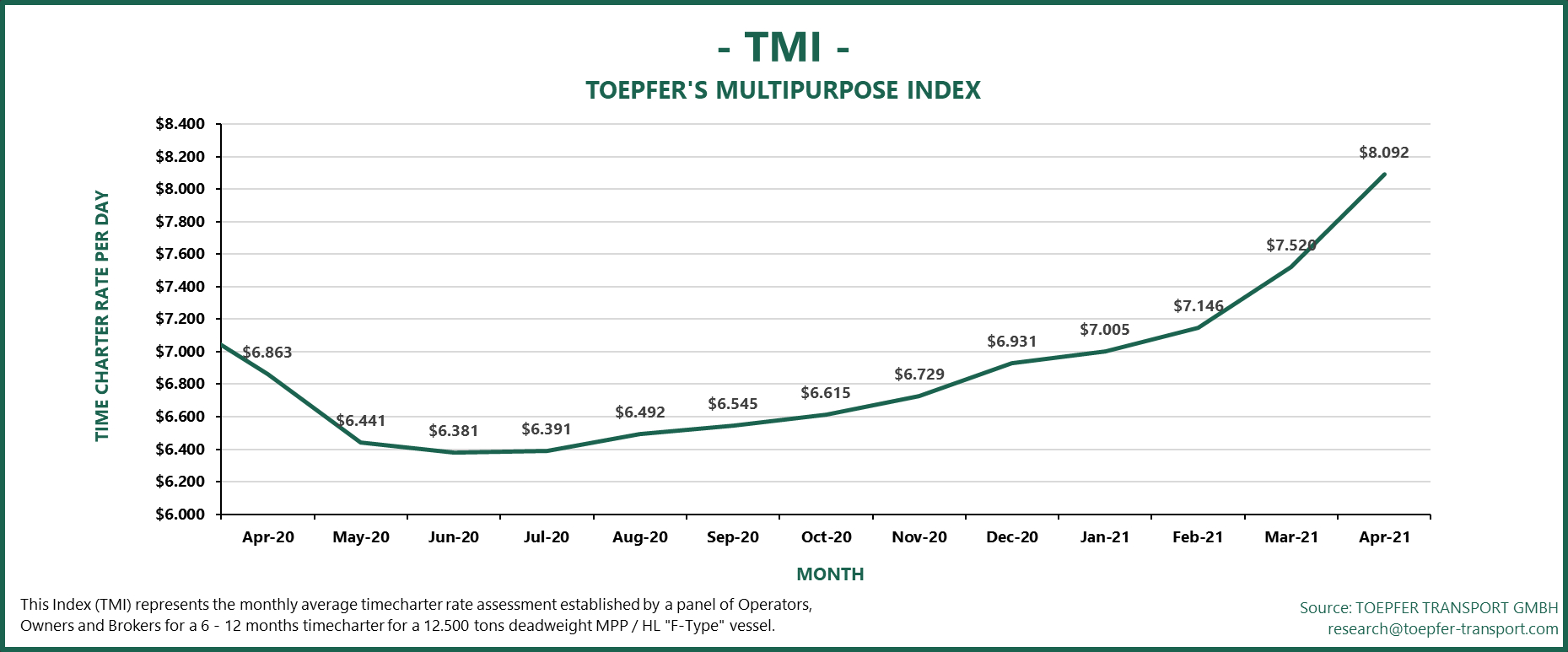

The charter rates have made a remarkable recovery since their low-point in June last year. Following the initial decline in demand as a result of the Covid-19 pandemic, the charter rates fell to USD 6,381 for a 12,500 dwt geared vessel. Since then, the charter rates climbed back up steadily until December, after which the increase accelerated driven by generally high demand and capacity issues in the container segment. Some project carriers posted pictures of their heavy-lift vessels fully loaded with containers on social media.

According to Toepfer, the strong wind energy market, recovery of the dry bulk market, positive oil price development and optimism after president Biden’s election also contribute to the flourishing demand for multipurpose vessels.

Several carriers have added vessels to their fleet in the past few months in order to fulfil customer’s needs. “Small operators who did not secure tonnage in the recent weaker times, have to pay high premiums to secure the ships they need to fulfil their obligations”, says Prehm.

Analysts expect the rates to continue to go up. “Various stakeholders believe that the current spring fever will become hot summer love”, Prehm said last month. Shipping analyst Drewry, however, expects the growth to slow in the second and third quarter of this year, although the conditions will remain favourable.

You just read one of our premium articles free of charge

Register now to keep reading premium articles.