“Project cargo demand stays positive if virus contained by Q4”

Drewry expects demand growth for breakbulk and project cargo to stay positive if the coronavirus is contained by the fourth quarter of 2020. “We expect demand for this year to be on par with 2019 levels, meaning no or minimal growth”, says Drewry’s breakbulk shipping analyst Susan Oatway.

There are a number of caveats to this outlook, depending on how the virus outbreak and the global economy develops over the second quarter.

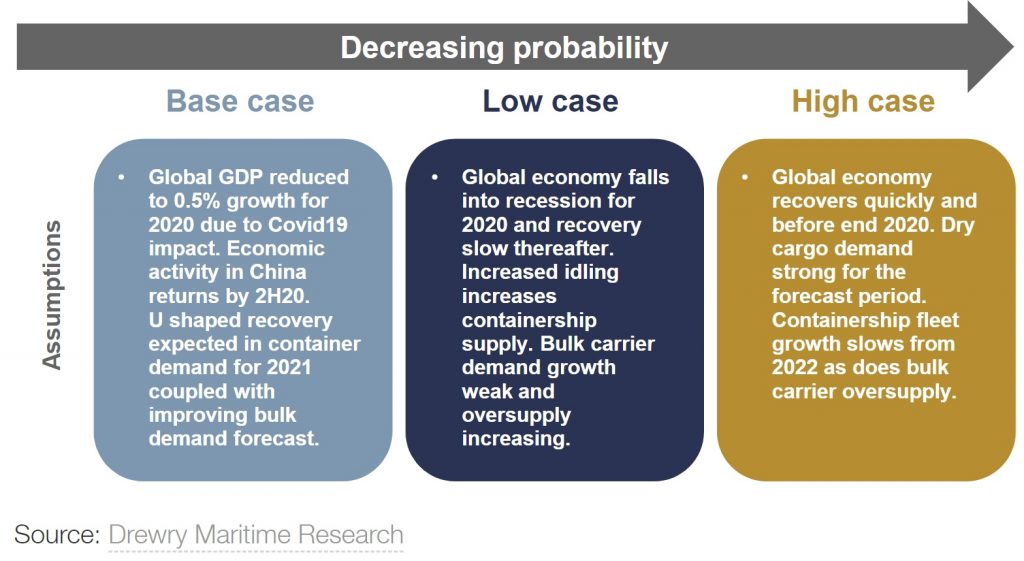

“These range from the fairly benign best case, where the global economy picks up in second half the year, to a negative scenario where the virus is not contained over 2020, leading to a global recession. The base case scenario is seen as most likely”, Oatway states in her latest market report.

Drewry’s base case scenario does not anticipate a global economic recovery before October. According to Oatway, “any recovery that had been anticipated for the second and third quarters is now expected to be delayed as some of the pent-up demand will have vanished due to both the longevity of the crisis and the oil market crash.”

Another key driver multipurpose and heavy-lift shipping is the competition from container and bulk carriers which are continuously and increasingly chasing breakbulk and project cargo. Drewry expects a U-shaped recovery in container demand over 2021 but this will be tempered with continued oversupply issues in this sector, resulting in little weakening of the market share taken by the container lines.

“It is also the case that once the switch has been made to containerisation, shippers and receivers are reluctant to revert due to the initial investment costs. It is therefore our expectation that market share is unlikely to revert back to multipurpose and heavy-lift vessels but the pace of loss of that share will be slower”, Oatway says.

As a result, Drewry expects demand growth for multipurpose and heavy-lift vessels to stagnate in the two years to 2021, growing at an average annual rate of just 0.3%. Average annual charter rates will remain at the same level as 2019. Before the pandemic, Drewry had initially forecasted rates to grow by 2% and even raised its forecast in January to 6% as all segments were showing positive signs of growth.

Worst case

Drewry’s best-case proposes a modest but positive GDP growth for 2020 with the competing sectors experiencing demand growth within their own segments, but this scenario is the least likely to become a reality. On the contrary, the worst-case scenario, anticipating a global economic recession over 2020, is increasing in likelihood.

If this is the case, large scale unemployment and business casualties lead to increasing uncertainty across global markets and a prolonged downturn in freight rates in the dry cargo sector.

For the breakbulk and project carriers, this is worsened by weak oil prices which remain at below USD 30/bbl for the foreseeable future. Demand for this sector is further squeezed by the container and bulk carriers and market share drops further. This leads to a negative demand outlook for the multipurpose and heavy-lift shipping companies.

Demolition

Drewry emphasizes that given the increased uncertainty in the world, the forecast should be viewed as “a broad guide to the likely direction of travel.” The only stable factor in the analysts’ outlook is the stagnation of the multipurpose fleet.

The virus outbreak is likely to have a negative short-term effect on demolition activity as ships are facing long quarantine delays but going forward, any suggestion of a global recession is likely to increase demolition candidates.

“Our forecast for this sector is modest, with most of the activity in the older smaller, less heavy-lift capable parts of the fleet. But we expect activity to increase by some 15-20% in comparison to previous years over 2020 and 2021”, Drewry states. On the other side of the supply equation, newbuilding activity has been weak and is not expected to pick up.

You just read one of our premium articles free of charge

Register now to keep reading premium articles.