Drewry: multipurpose index continues downward trend into the holidays season

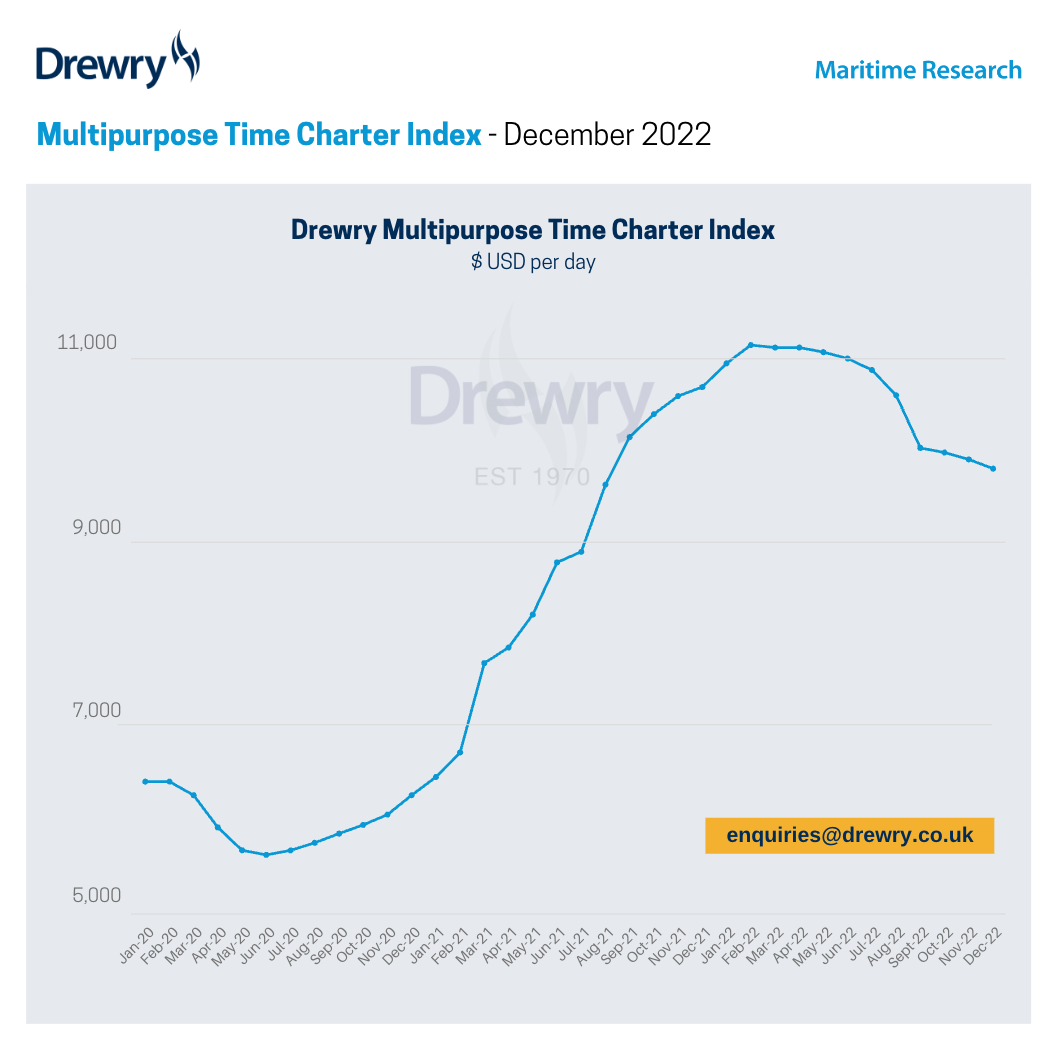

Charter rates in the multipurpose sector are continuing to decline as reflected by the latest figures in the Drewry Multipurpose Time Charter Index. The Index slipped again in November, reaching $9,950/day, the consultancy said in its latest monthly report.

November figures were slightly above Drewry’s forecast and some 0.7 percent below October. Rates in the smaller short-sea sector were steadier than those for the larger vessels, leading to a difference of around -1.2 percent across Drewry’s basket of trades. Drewry expect the trend to continue to the year end as holidays in most parts of the world impact both demand and port stays, with the potential to shave a further percentage point from the Index as the year closes.

According to Drewry, the short-sea sector was more stable than the longer haul over the month, but across the board most owners appear to be fixed over the holiday period, in an attempt to mitigate any downtime in ports. This will also support the market somewhat, as demand remains steady in most sectors, with continued growth in the project market.

Going forward to over the year-end, an earlier Chinese New Year, coupled with concerns from that country regarding unrest, and the continued pressure on energy supplies in Europe, result in a weakening market outlook. However, Drewry are not seeing the volatility of the competing sectors, albeit that this will result in further market encroachment into 2023. Drewry therefore expect the Index to fall to a forecast average of $9,850 per day over December. This would represent a drop of around 8 percent YoY and a 10 percent drop since January 2021, but still remains some 57 percent above December 2020.

You just read one of our premium articles free of charge

Register now to keep reading premium articles.