Drewry: multipurpose index drop slows in October

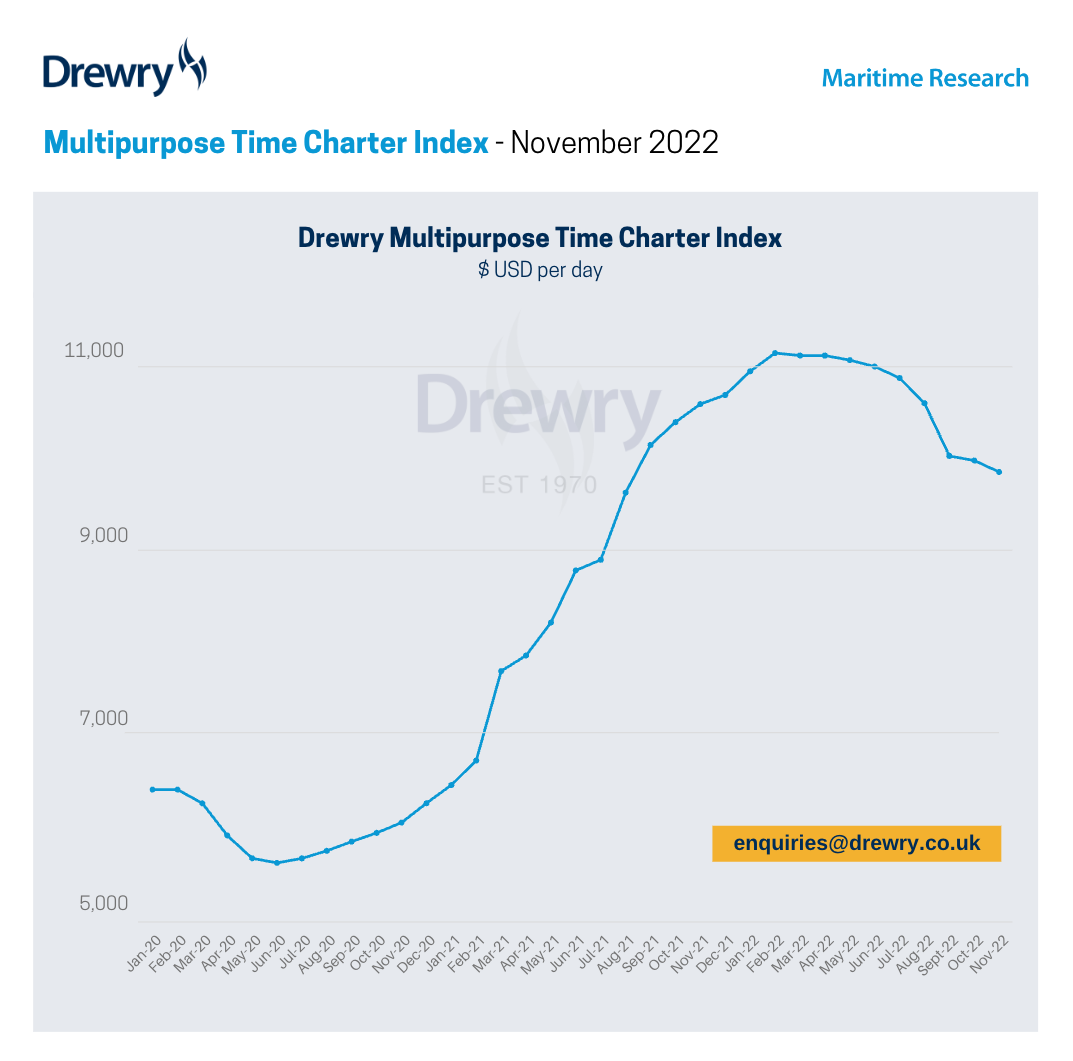

Spot market steadied over October which reflected in the Drewry Multipurpose Time Charter Index that slipped again, although slower compared to the previous month. The consultancy noted that its multipurpose index stoped just above the $10,000 mark, at $10,025 per day over October.

Demand levels in both the short-sea and project carrier sectors have been steady, while rates in the bulk sector have, at best been flat, container rates continued to fall. This mix has resulted in rates for Drewry’s basket of trades falling by just 0.5 percent over the month to an average $10,025 per day. The consultancy expects the trend to continue into November, with container rates adding further pressure to bring the index below $10,000 per day in November.

October witnessed a steadying of the spot market in the short-sea sector, underpinned somewhat by increases in bunker prices and the need for cargo to be cleared before the year end. Meanwhile the project cargo sector is still benefiting from forward contracts for both wind power and oil & gas, the latter on the back of those strong oil prices. Any decline in rates at the moment is largely driven by increased capacity and pressure from the container sector.

Drewry expect that to continue into November, with the forecast for the Index to drop a further 1 percent, to reach around $9,900 per day. This is some 12 percent down from the peak of the market and 7 percent down from November 2021 but remains 63 percent ahead of November 2020.