MPP spot market falls short of expectations

While shippers and carriers keep talking of upcoming demand the activity levels remain subdued, leaving even the experienced analysts at a loss for words, shrugging their shoulders. Both shippers and carriers keep reporting upcoming demand, especially in the premium sector, with an increasing impetus from the oil and gas sector. However, with the actual level of activity and availability of prompt cargo remains weak, charterers remain cautious with regards to charter rates and durations, Toepfer Transport said in its latest MPP Shipping Report.

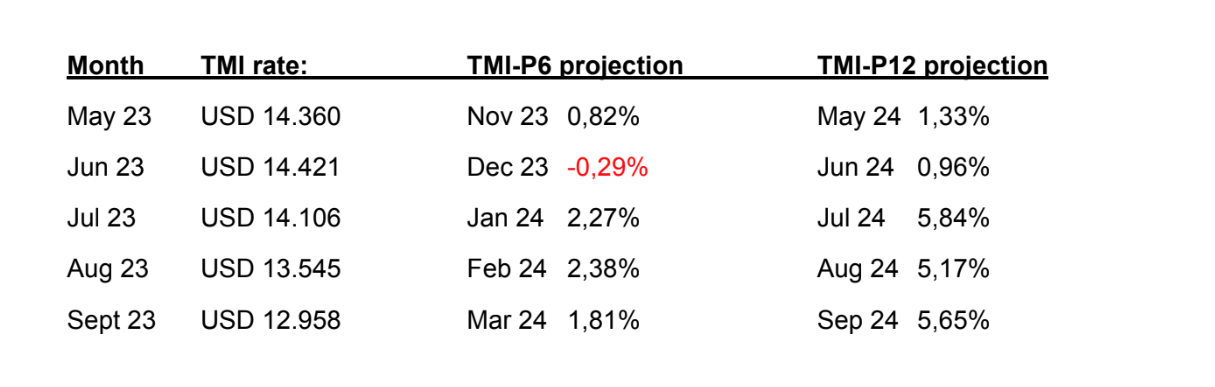

The spot market in the summer months continued to fall short of MPP owners’ and operators’ expectations. At the same time, confidence remains that the period charter rates will recover in the next 12 months as demand is anticipated to pick up. “This is what we can read from the TMI-P6 and TMI-P12 assessments, a voluntary projection that we collect from our panellists on a monthly basis,” Toepfer’s analysts say.

For now, though, the reference fixtures are mirroring the gap between short and long-term time charter rate levels. Particularly the cargo volumes and enquiries remain weak in the Atlantic spot market with the Far East not showing much upside either. Owners currently need a long breath to counter the pressure as charterers are trying hard to push rate levels further southwards.

The period time charter rates for an F-Type 12.500 tons-deadweight MPP vessel are back to the levels achieved in August 2021, when rates started to spike after a 12-year cyclical slump. In the summer months of July and August 2023, the downward trajectory gained a stronger pace and sent the rates for a 6-12 months’ time charter close to the 10-year average.

“The last quarter of the year will be crucial to provide shipowners with optimism and security as only a sustainable, adequate income will allow them to take necessary measures and investments for the forthcoming challenges around global and regional regulations to meet climate targets,” the analysts say.

Activity increasing in the MPP newbuilding market

The newbuilding market has remained strong for several months now. This follows a period of stagnation in the first half of the year. According to the Hamburg-based shipbroker, it seems that newbuilding prices will not fall in the medium-term future, mainly driven by labour shortages and inflation.

Toepfer reports that German owners Auerbach and Krey have ordered a total of four F500-type vessels. “Several other owners are negotiating with Chinese shipyards with some of them having already signed LOI’s in their hands, but there are no effective orders to report,” analysts said.

The second-hand market

There is very little activity in the second-hand market and generally, there is a huge gap between the prices the sellers and buyers expect.

“We also see an increasing number of deals failing due to compliance regulations. It is obvious that ‘K C’ is getting more attention ‘Knowing your client’ is an issue that causes increasing concern and very often it takes a longer time for a seller or sellers’ bank to find out who is standing behind a purchase enquiry and an unknown company name. In the Western world, a Russian background will no longer be supported due to imposed sanctions following the Ukraine war. Russian sellers that have been an important driver in the MPP sale and purchase market for many years, have been withdrawn from the potential buyer list of major MPP owners and operators who intend to sell their ships,” Toepfer’s analysts say.

Goodbye MV Shun Da Yun

The only vessel that was sent to the beaches, MV Shun Da Yun, a 36-L Type. With an impressive lifespan of 50 years, it was finally time to say goodbye for good after a long trading career.

In the first twenty years after her delivery from the German shipyard Weser Seebeckwerft, Bremerhaven, the ship had been owned and operated by Chipolbrok and Cosco.

“The long service of MV Shun Da Yun no doubt attests to a good quality of steel and construction work and, we can hopefully assume, good maintenance for the most part of the ship’s trading life,” the analysts say.

You just read one of our premium articles free of charge

Register now to keep reading premium articles.