A half year of stagnation for MPP charter market

The multipurpose vessel (MPP) charter market in the first half of 2023 could be summarised by a single word, stagnation, according to the latest quarterly report by Toepfer Transport. Research specialists at the Hamburg-based shipbroker note that there is a slow decline in the rates, and the longer the spot market remains poor, the trend will endure.

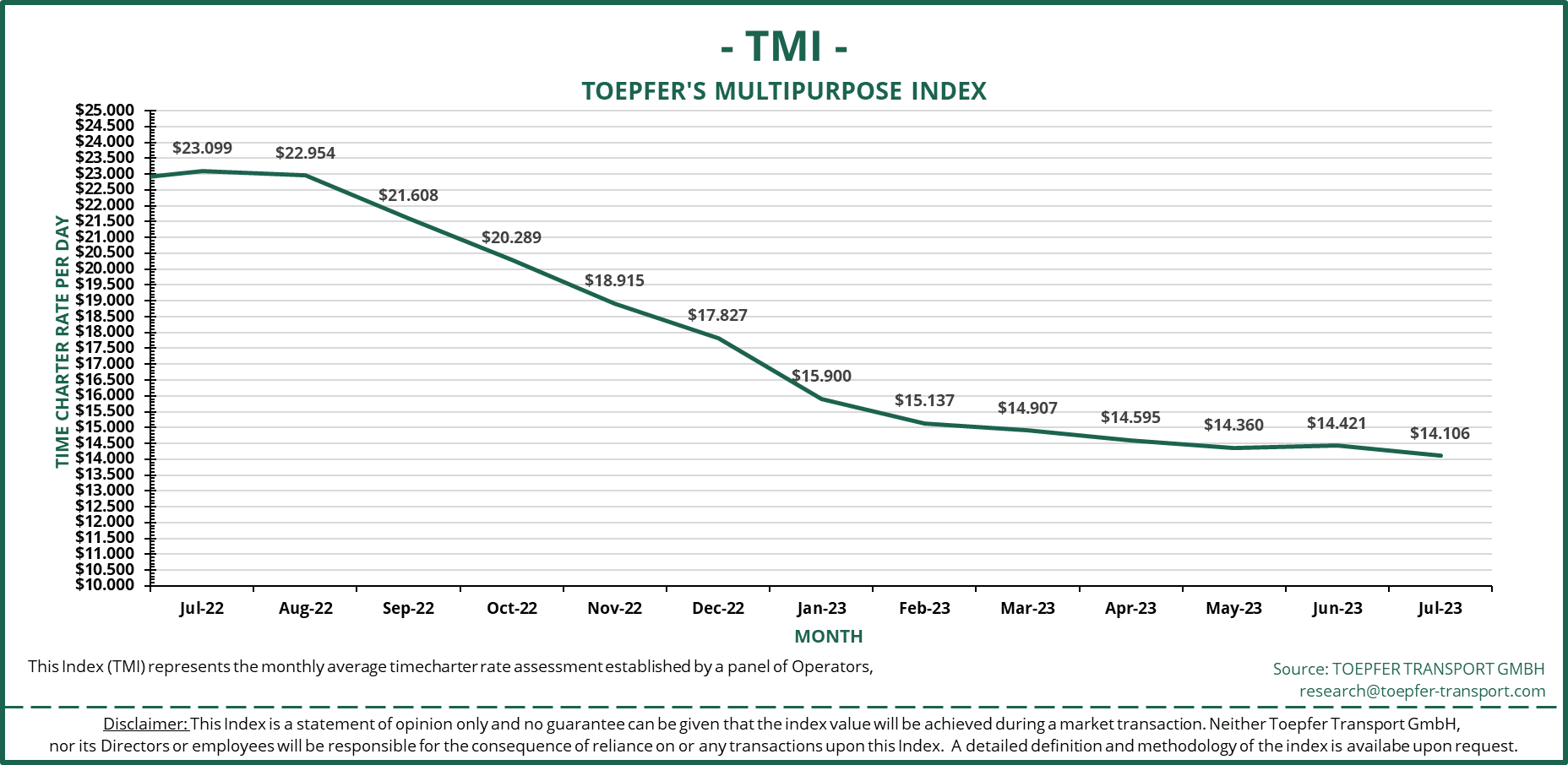

“The impact of the poor spot market on the TMI index rate is increasing and the weakness of the Handysize Bulkcarrier and Container markets slightly start to dampen the still positive outlook on the MPP demand side,” Toepfer Transport’s researchers noted in the monthly Toepfer MPP Index briefing.

According to the briefing, the Toepfer MPP Index (TMI) for the month of July landed at $14,106 per day, which is a 2.19 per cent drop compared to the moth of June when the TMI stood at $14,421 per day. Toepfer Transport expects the rates over the following six months to come back up 2.27 per cent. For the following twelve months, the shipbroker foresees an index rise of 5.84 per cent.

Compared to July 2022, when TMI stood at $23,099/day, July 2023 figures are 38.9 per cent down.

The shipbroker notes in its report that the fixtures made confirm the slow decline of the index. Especially when a vessel is open in a less preferred geographical area, the pressure on the charter rate gets quite high. The long-term view, however, shows the current charter rate levels are far above the historical averages meaning the market rates are still a quite healthy levels.

Active MPP newbuildings market in Q2

Toepfer Transport’s report shows ‘extraordinary’ activity in the newbuilding market. “There are only very few delivery slots left for 2025 and even 2026 deliveries are hard to get,” the report reads. The high demand situation has played into the hands of shipyards with the newbuilding prices increasing quite rapidly.

Toepfer Transport also noted that the prices for 9,000 dwt, 12,500 dwt and 30,000 dwt newbuilds edged up from June to July 2023. To remind, newbuilding vessel prices were $19 million, $30 million and $50 million across the board in June, and the latest report shows the price edging up to $20 million, $30.5 million and $52 million across the board.

However, with the investors spending money without much regard for over-supply in certain markets like containers, it becomes more difficult dot the MPP sector to find shipyards interested in building their vessels at all. Toepfer notes that the remaining yards prefer building mature designs instead of the more modern optimised vessel designs.

This is reflected in the orders for a total of six F500 newbuildings by German owners.

Second-hand price decline continues

Prices in the second-hand market have continued their slow decline, in line with the stagnation in the charter market. In extraordinary circumstances, however, it is still possible to sell vessels at high prices.

Toepfer’s research team noted in the report that the sale and purchase market is still quite active but only a few deals really get concluded. “This is not only caused by the current development of the time charter and freight rates but more due to some buyers failing during the KYC checks.

One vessel, namely the 1998-built MV Kamo, headed to the scrap yard, leaving the market. It was one of the last ships with one heavylift crane/boom and one of the few remaining vessels built in Japan.

Read also:

- No effective MPP newbuild orders in Q1, Toepfer Transport says

- Esgian partners with Toepfer Transport for MPP sector insight

You just read one of our premium articles free of charge

Register now to keep reading premium articles.