MPV-market expected to grow by 2% despite weakened economy

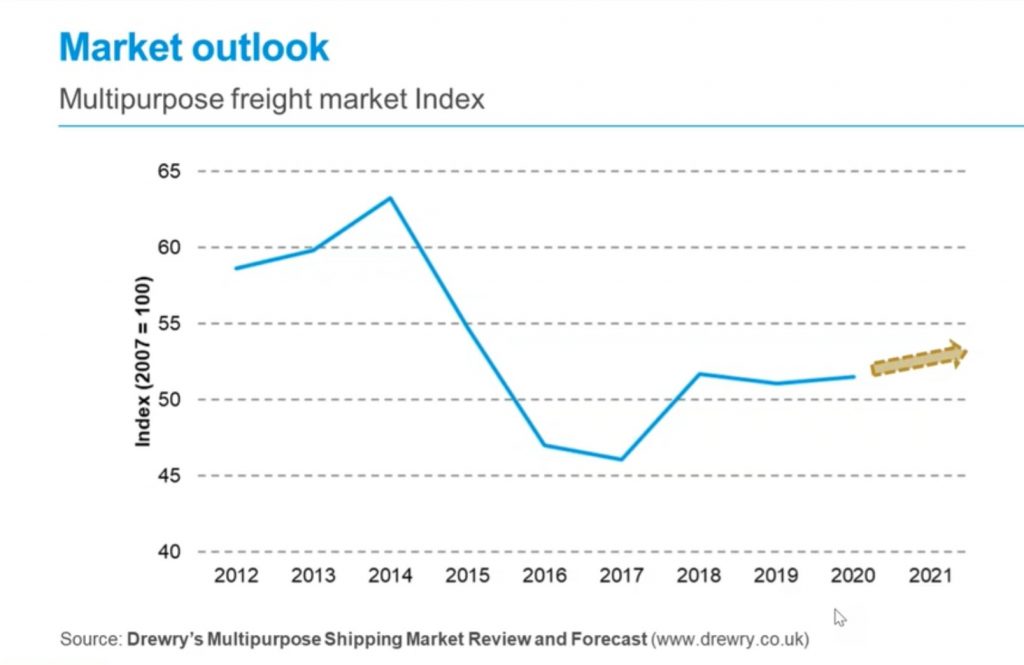

The fragile global economy has weakened the outlook for the multipurpose shipping industry but despite the challenges and uncertainties, the market is still expected to grow by 2% annually until the end of 2021, forecasts Drewry.

“Overall improved global trade and improving markets in the container and dry bulk shipping industry have led to increased demand and market share for multipurpose vessels”, says Susan Oatway, Drewry’s lead analyst for the multipurpose and heavy-lift shipping industry.

Drewry forecasts total dry bulk demand will grow by 4.2% annually until the end of 2021, with bulk cargo growing by 2.7% and general cargo by 1.5%. This growth is partially driven by positive developments in renewable energy, especially in on- and offshore wind, and improving breakbulk markets.

“It’s not a straightforward correlation to the market share of multipurpose shipping because of competition from other sectors, but we expect the share of MPV-operators to improve, albeit slightly at a rate of 1.1%”, Oatway adds.

Combining the growth in cargo demand and market share, Oatway expects the MPV-demand to grow by 2% annually over the next three years. Freight rates are also expected to strengthen for the remainder of 2019 and onwards but like demand growth, it will be at slightly lowers levels than previously forecasted.

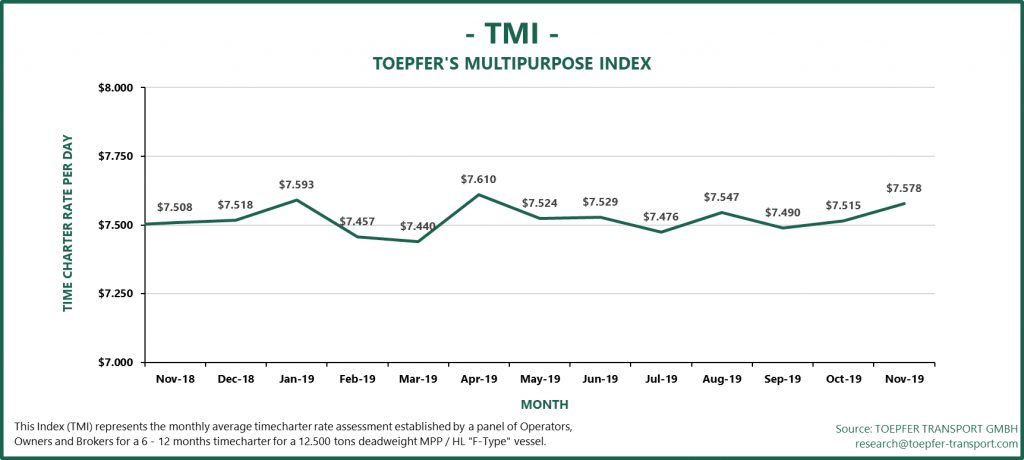

The forecast of Drewry corresponds to the multipurpose shipping index of Toepfer Transport which shows improving time charter rates since September. Shipowners currently receive an average day rate of USD 7,578 for their multipurpose vessels, up from USD 7,490 in September and USD 7,508 in November last year.

Weakened economy and trade war

The pressure on the sector’s recovery is mostly caused by a weakened and fragile global economy and the ongoing trade war between the US and China, which has severely impacted investor confidence.

Main drivers for project cargo are global GDP and the oil price, which currently stands at USD 61.4 per barrel (Brent). “The latest forecast of global GDP has been reduced from 3.5% in January to 3.2% in July and is expected to decrease even further”, says Oatway. “At the same time, oil prices have fallen consistently over the past six months and our expectation is that the prices will remain below the USD 60 per barrel on average for the foreseeable future. That is not quite the level of confidence that the sector needs.”

Continued trade tensions have also weakened expectations for growth. In its base-case scenario of 2% annual growth, the trade war rumbles on as it currently is. However, if the trade war would escalate further demand growth for multipurpose vessels could decrease further to 1.6% annual growth. On the contrary, if trade relations were to improve demand could grow to 2.6%.

IMO 2020

A big question that remains is how the industry will respond to IMO 2020. It was previously expected that the new sulphur regulations would lead to increased demolition of the aged simple vessel fleet, but that is not the case.

“Demolition has been on the decline for some time”, says Oatway. “In 2018 we reached a historic low and 2019 will struggle to reach even those levels. We do expect levels to rise over the next few years and some of that will be because of increased environmental legislation, but we don’t see IMO 2020 have a significant impact as most of the older tonnage already trades shortsea and sails in the emission control zones.”

Another reason IMO 2020 won’t have a big impact is that there’s only one major owner investing in scrubbers. Most ships will simply switch to low sulphur fuel and the extra costs will, in one way or another, be passed onto the cargo owners.