Charter rates exceed pre-pandemic level

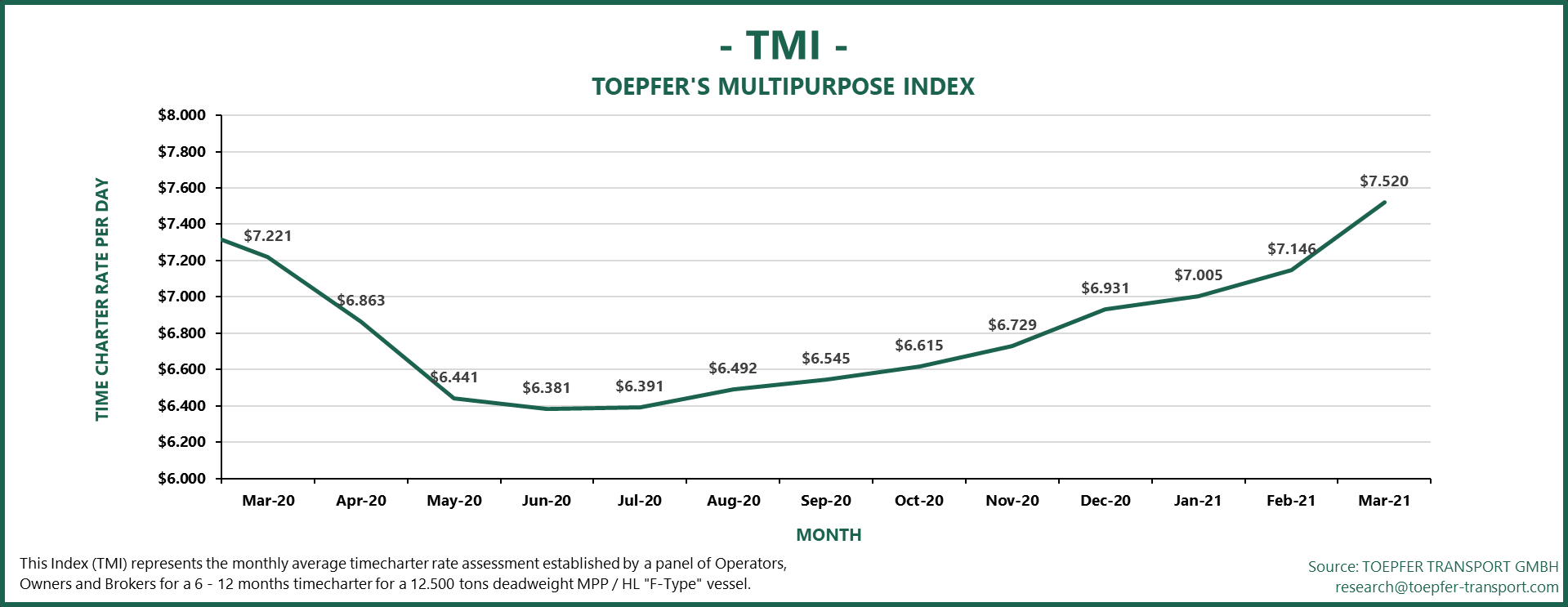

Almost exactly one year after the Covid-19 pandemic hit Europe, the charter rates for multipurpose and heavy-lift vessels are back at their pre-pandemic level and even passed it. The average day rate for a geared 12,500 dwt vessel now stands at USD 7,520, according to Toepfer’s Multipurpose Shipping Index.

Compared to March last year the day rate is now 299 dollars higher. However, in March last year, the decline of the charter rates had already set in. But even compared to February 2020, when the effect of the pandemic had not yet kicked in, the current day rate is still 105 dollars higher.

Even better news for breakbulk carriers is that the increase in charter rates accelerated last month. Since the low point in June last year, the charter rates have consistently increased month on month by about 60 to 150 dollars, with the exception of December 2020 when the holiday season led to a spike of 201 dollars. This month, however, the rates increased by 299 dollars, or 4%, compared to February when the average day rate amounted to USD 7,146.

“Hot summer love”

Two factors seem to play an important role in the rate recovery. First, there’s a general increase in demand for goods and transport again. According to shipbroker Toepfer, demand in the multipurpose sector is flourishing, with wind power, cargo overflow from the container industry, recovery of the bulk sector, optimism after the US election, and the oil price development as the main drivers. And things are likely to continue to improve, says Toepfer’s analyst Yorck Niclas Prehm. “Various stakeholders believe that the current spring fever will become hot summer love”, he says.

In terms of project cargo, the wind industry keeps performing at high growth levels but the oil and gas industry is improving as well, with the oil price recovering to the 60 dollars price point (Brent). This is a huge improvement compared to the low point in May when a barrel of Brent oil sold for less than 20 dollars and US traders were even paying to get rid of their stocks.

Disrupted container market

Another major driver of the rapid rate recovery is the market situation in the container industry. High demand driven by low stocks in the US and Europe and a shortage of empty containers has caused freight rates for containers to skyrocket. Spot rates are still two and a half times higher than last year, according to the Shanghai Containerized Freight Index.

For the container liners, the situation has led to record high profits exceeding a billion dollars but a low point in service, with delays in 65% of all sailings. The US especially is plagued by long waiting times. “Los Angeles/Long Beach has 31 vessels waiting, Oakland has 13 vessels waiting and Savannah has 16 vessels waiting”, says container shipping analyst Lars Jensen of SeaIntelligence Consulting, adding that no material improvement was showing in the past few weeks.

Upsides

For the multipurpose market, the situation has had several upsides. Freight forwarders and shippers are chartering multipurpose vessels to circumvent the high rates and unreliable services of the container liners and breakbulk carriers are also contracted to move containers themself. United O7 Asia recently posted a photo of the heavy-lift vessel UHL Faith, which was filled to the brim with containers. Companies like AAL Shipping are also actively advertising their container carrying capabilities.

In addition to the extra business and bookings, the situation has also eased the competition from the container carriers, which in recent years have been vigorously chasing breakbulk and project cargo. Speaking at the Project Cargo Summit 2021, Hapag-Lloyd’s senior director of niche products Sara Schlüter said the situation is “heavily impacting our offering and handling of special cargo.”

Analysts do not expect much improvement in the second quarter and say that the current market conditions could even persist for the remainder of the year. While that is bad news for most freight forwarders and shippers, it will likely be welcomed by the breakbulk carriers.

You just read one of our premium articles free of charge

Register now to keep reading premium articles.