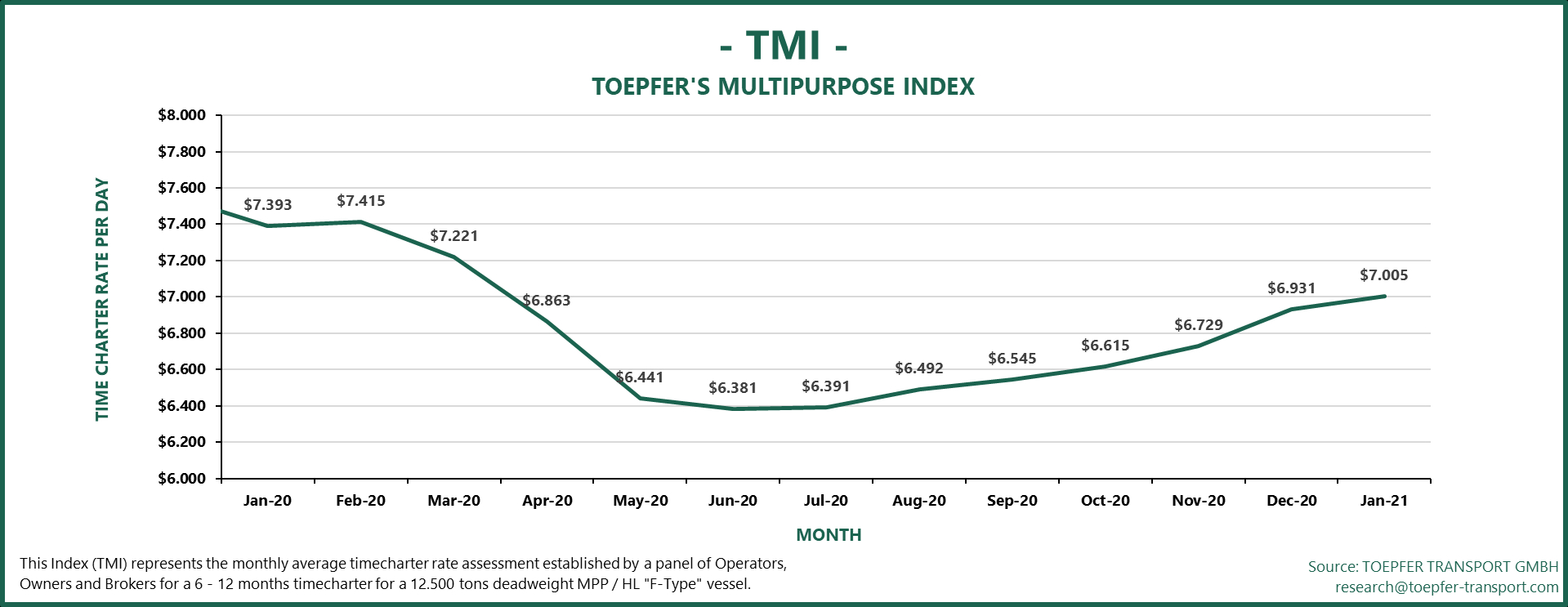

Charter rates pass USD 7,000 mark

The charter rates for multipurpose vessels continue their positive trend into the new year and have broken through the USD 7,000 mark. The average day rate for 12,500 dwt MPP vessel now stands at USD 7,005,- according to Toepfer’s Multipurpose Shipping Index.

The average day rate increased from USD 6,931 in December to USD 7,005 in January, reflecting a rate hike of 74 dollars. That means that in comparison to last month, the pace of the recovery has slowed a little as December showed an increase of 202 dollars compared to November. That month, however, the rates experienced an extra push due to the high demand peak of the holiday season and the shortage of empty containers, which prompted both container carriers and shippers to charter multipurpose tonnage to cover their needs.

While the continued recovery is good news for the multipurpose and heavy-lift vessel operators, the average rate still is nearly 400 dollars below its level of January last year.

While the peak demand of the holiday season and Brexit preparations are over, breakbulk carriers may still see extra demand coming from the container industry as the empty container crunch has not been solved yet.

Shortage to persist

According to analyst firm SeaIntelligence Consulting, the shortage of empty containers will at least last into January. And to end the situation by then, the carriers will need to both procure new containers and reposition the existing ones aggressively.

“This is exactly the strategy that carriers are currently pursuing. However, this strategy causes significant problems for back-haul shippers”, says SeaIntelligence CEO Alan Murphy.

Murphy says the market is thus faced with a stark choice, with each option having its own effect on the availability of the empty containers. “Either the carriers pursue the current strategy, and there is the possibility of resolving the container shortage during January, or the carriers reduce their aggressive repositioning strategy in order to serve back-haul shippers, but then the consequence is that the empty shortage problem will persist into at least February, and possibly beyond”, the analyst concludes.