Maersk uses its sophisticated software to grow in breakbulk

You can’t see it from the outside, but Maersk’s container vessels bring a lot more into port than just containers. There is some piece of breakbulk on every sailing nowadays and the Danish shipping giant is using its sophisticated software to further increase its market share.

For years, Maersk has been a frontrunner in maritime digitalization. Drawing inspiration from the aviation and e-commerce industry, the shipping company has made the booking of a container as easy as the purchasing of an airline ticket.

The container carrier is also among a small group of maritime pioneers experimenting with blockchain and the 2017 cyber attack on APM Terminals has learned the company a lot about online security.

Carrying all this experience with it, Maersk is using digitalization to expand its breakbulk business as well. The company has set-up an online quotation and booking platform for out-of-gauge and breakbulk cargo which, according to Regional Special Cargo Manager Jesse Dean Turner, has shortened the quotation process from “many days to hours and sometimes even minutes.”

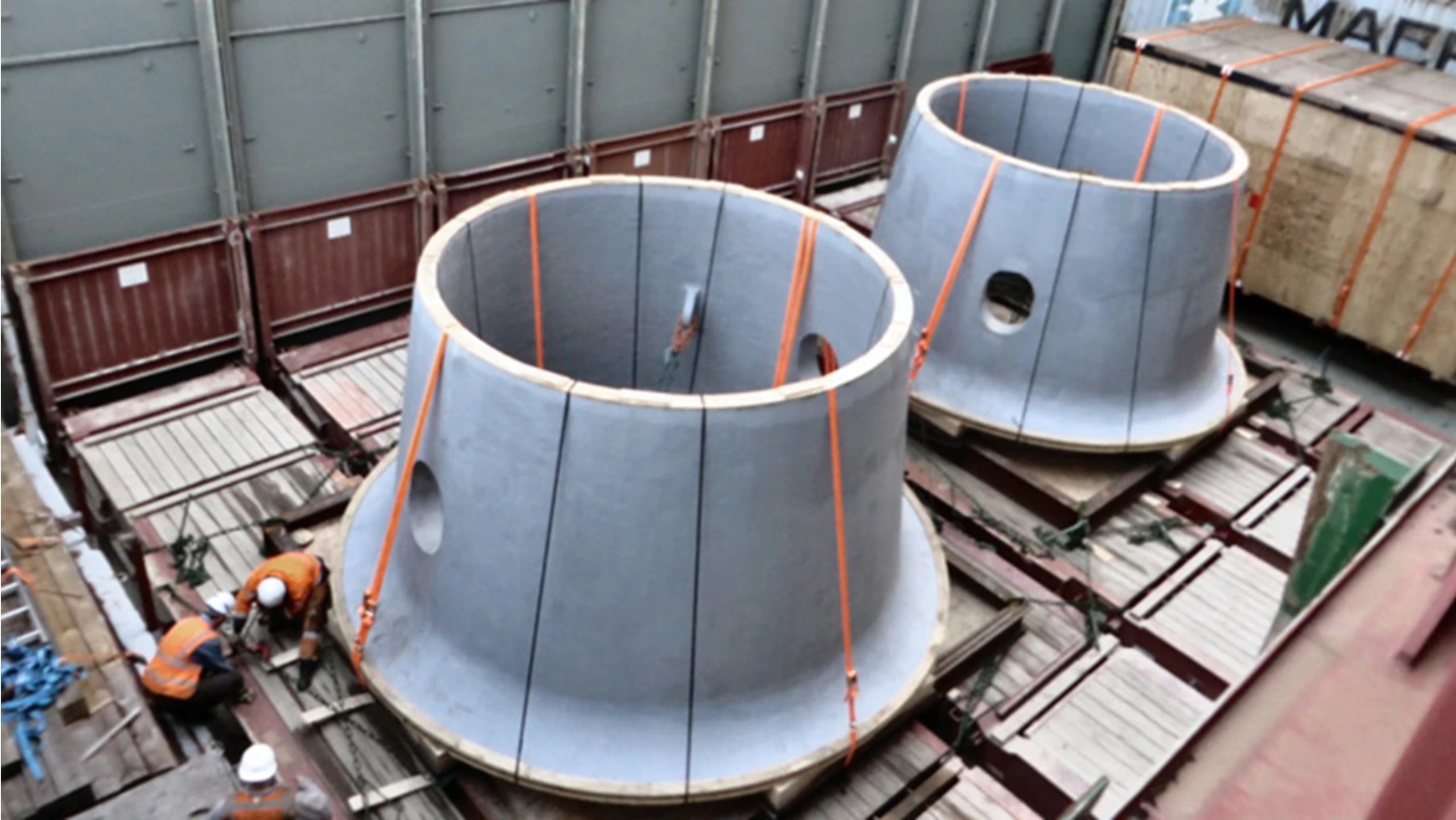

This has helped the company to increase its breakbulk volume. “There is some piece of special cargo on every sailing nowadays”, says Turner. The reason you won’t see these cargoes from the outside is because they’re generally stowed below deck. Maersk accepts breakbulk and project cargo on all trades including the major Asia-Europe trade lanes, which are served by the company’s ultra-large 20,000+ teu container vessels. “The probability that these vessels carry breakbulk is even bigger, just because there’s so much more cargo being moved”, Turner adds.

Test

PCJ has tested the online platform, requesting a quote to move one of Wärstilä’s biggest diesel engines (16V46F) from Vaasa in Finland to Perth in Australia. What stood out is the simplicity of the tool. Simply select the type of cargo you want to move, choose if you want to ship it as breakbulk or out-of-gauge cargo, fill in the destination and place of pick-up, add the dimensions, weight and preferably a drawing and press ‘send’.

Within 14 hours we received a reply. We were advised to ship the 233-tonne engine (12.7 x 4.7 x 6 metres) as breakbulk instead of the requested out-of-gauge cargo because it was too big to fit on a flat rack.

The difference is that out-of-gauge cargoes exceed the dimensions of a flat rack or open top container by either length, width or height, but can still be unitised in containers, whereas breakbulk units are simply too large to put on any sort of rack or open-top container.

“To ship these units, we lay a bed of flat racks over a tier of containers and then lash the cargo on top of it”, Turner says. Maersk has shipped cargoes of up to 46 metres in length this way.

Limitations

When it comes to breakbulk shipping, the carrier’s value proposition is its unrivalled shipping network and high-frequency sailings. However, there are limitations to what the carrier can handle as its reliant on shoreside equipment in the ports of pick-up and offloading.

When we can, we use mobile or floating cranes to solve this.

This was also the case in our test request. 24 hours after we agreed to ship the engine as breakbulk, Maersk had checked the ports and routing and informed us that it would not be able to deliver the engine in Perth aboard one of its container vessels. “Besides multiple transshipments involved, major reasons are that the connection and container terminal involved can not accept said breakbulk cargo”, the reply read.

“Handling of breakbulk is part of our contracts with the container terminals and on trades where we move a lot of special cargo, our partners usually have spreaders ready”, Turner says. “But of course, we are dependent on the capability of the shore cranes and this means that some destinations have limitations in regards to size and weight. When we can we use mobile or floating cranes to solve this.”

Door-to-door logistics

Maersk is primarily known as a shipping company and ocean transport is indeed the company’s core business. But since 2016, the carrier has been undergoing a transformation process to become an integrated logistics provider.

As part of this transformation, many of the energy-related subsidiaries like Maersk Oil, Maersk Drilling and Maersk Tankers were divested to fully focus on marine transportation instead. At the time of the announcement late 2016, CEO Soren Skou said the goal was to have Maersk Line, APM Terminals, Svitzer, Damco and Maersk Container Industry operate as one company with several brands.

Together with a local trucking company, we drove the machine across the entire country.”

Two important goals for the new company were to become more cost-efficient through digitalization and to pick up and deliver cargo further inland. The first goal has largely been realized and the company is now working hard to achieve the other one as well.

“We recently executed a project that illustrates this quite well”, says Turner. “We were asked to urgently move an oversized piece of machinery from Montreal to British Columbia in Canada. The time frame was too short to ship it through the Panama Canal, but the cargo was too large to move it by rail. So instead, we partnered with a local trucking company and drove the machine across the entire country.”

For Maersk, this was an important project. Turner: “When we came into this market, our biggest challenge was to improve the way we move special cargo. A big part of that was to set up a dedicated team who understand the market and speak the language. Digitalization then helped us to increase efficiency and now, our door-to-door approach opens up new markets.”

good day,

interesting,

for the PCJ trial shipment, does it mean that the online system took 14hrs to reply that the cargo could not be shipped as OOG but should be as bbk, and by the way not offering you a quote, and then an additional 24hrs to eventually reply that it cannot be accepted as Perth terminal has not the capacity to handle it ?

rgds

Hi Stephane, thank you for your comment. In a nutshell, yes, but as Jesse explains Maersk looks for alternative solutions like mobile or harbour cranes to workaround port limitations. I’m sure that in today’s environment, with container volumes dropping substantially, they took a good look at the possibilities. I suppose the real question now is: would CMA CGM be able to do better? 😉

Good day Thobias,

there are 2 subjects in your reply and the most important is the fact that MSK, CMA CGM and other container carriers are not looking at shipping project cargoes in “today’s environement…” only, but are offering such ‘containerisation’ alternative to customers, in peak and trough period since decades, and thanks to the key advantages related to our core models aside the more conventional transport modes.

for the 2nd part, bbk enquiries deserve tailor-made commercial and technical studies.

I am not going to compare our capabilities with our MSK colleagues, just taking that opportunity to repeat that container carriers offer a fair and competitive alternative to carry oversized and heavy lift cargoes.

Of course, I did not mean to imply that container carriers only look at project cargo when container volumes are down. Just that Maersk wouldn’t have passed up the opportunity lightly. They did not know it was PCJ requesting the quote, btw.